Do you really know your Small-caps? Quantilia asked the Small-Caps team at Kempen Capital Management to share how they confidently navigate the world of small cap investment.

A focus on Small-caps

Quantilia: The different investment strategies of Kempen our clients can invest in, are managed by Kempen Capital Management. Who is the ultimate owner of Kempen and what is your company culture?

Kempen Capital Management: Kempen Capital Management N.V. (‘Kempen’) is part of Kempen & Co N.V., founded in 1903 and providing specialised financial services in asset management, corporate finance and securities brokerage. Kempen & Co N.V. is wholly owned by Van Lanschot Kempen N.V., which is the oldest independent Dutch bank with a history dating back to 1737.

Van Lanschot Kempen N.V. is listed on Euronext Amsterdam.

At Kempen we believe that long-term success requires continuity and a strong culture built on a set of clearly defined values.

We believe in building long-term partnerships which are based on transparency and trust. Our strong culture is performance driven and team oriented. We are committed to retaining and investing in a mix of talented and experienced staff, with the ability to harness leading-edge technology.

We consider our clients’ goals as our goals, which is why Kempen and its employees work with clients to invest in the funds which are right for them.

Quantilia : One area of strong focus within Kempen clearly is small-caps, why this asset class? And what is your history in this asset class?

Kempen Capital Management: One of the strongest arguments for investing in small-caps is the fact that average returns have consistently been higher for small-caps than for large-caps over longer periods of time. This finding has been extensively documented in academic literature established in the 1980s, based on data spanning multiple decades and is better known as the small-cap premium. There are several fundamental reasons that could explain the small-cap premium.

- Firstly, many small-cap companies are focused. They often specialise in niche markets and ideally, they are or become dominant in the markets they serve.

- Secondly, management is generally more entrepreneurial, particularly if the founder(s) is / are still active. Their relatively small size makes them more agile and hence enables them to better adapt to changes in the external environment. Senior management of small-caps often own a significant stake in their company which creates a strong alignment of interests with the other investors.

- Lastly, the strong performance of small-caps can be accredited to the fact that they regularly become take-over candidates.

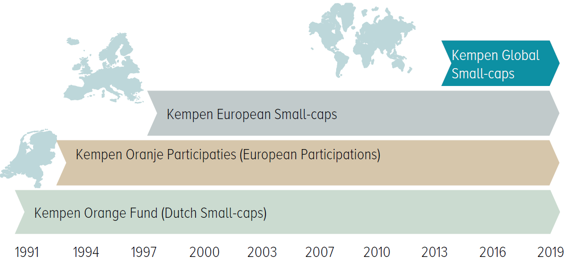

Kempen’s successful 25 year plus track record of managing Dutch Small-caps and Kempen’s track record of 20 years of managing European Small-cap portfolios are clear evidence that experienced and dedicated small-cap managers can outperform their benchmarks over the longer term.

Source: Kempen

Quantilia: So, what you are saying is that Small caps are said to deliver better returns in the long run. How do you – as a niche asset manager in small caps – manage the higher volatility of these stocks in the short term?

Kempen Capital Management: Yes, we acknowledge the higher volatility seen in small-caps. We are long term investors looking for sustainable returns through different business cycles and therefore accept some small caps can be more volatile in the short term before their real value comes out. There are cases where we even benefit from short-term volatility.

- Our bottom-up investment philosophy is based on long-term value. We believe that the stock market is generally too focused on the short-term; stock prices regularly over- and undershoot; often valuations, particularly for small-cap stocks, do not reflect the intrinsic value of the companies listed.

- As long-term engaged shareholders, we focus primarily on the fundamentals of the business we invest in. Our in-depth stock specific analysis, combined with our long-term vision, allows us to take advantage of mispricings in the market. We do not shy away from taking contrarian views.

- Our approach to ESG has qualified the strategy for use in sustainable portfolios for some of our clients. As well as excluding the most controversial sectors such as tobacco and weapons producers, we fully integrate ESG in our investment process and actively engage with companies on ESG topics.

- Our experience and insight across multiple sectors and regions have resulted in a well-diversified portfolio of 60 – 90 companies. The strategy is managed by an experienced team of four dedicated portfolio managers.

In addition to our investment approach, we have a dedicated Risk Management team who monitors the risks of the portfolio associated with our approach.

Bottom-up investment approach based on long term value

Quantilia: What is Kempen’s specific approach to small caps investing? How do you assess the companies you invest in?

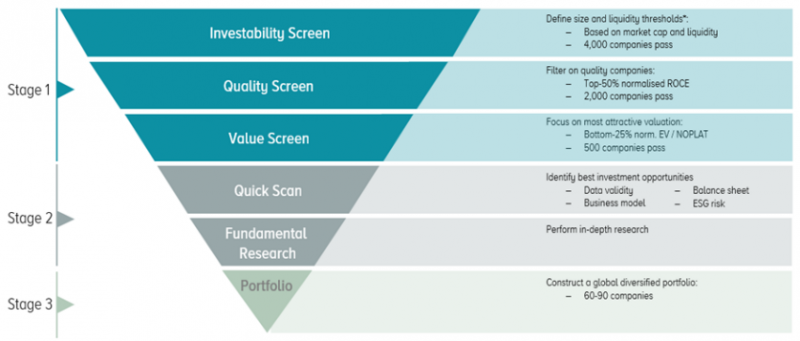

Kempen Capital Management: The investment process consists of three main stages, as shown in the graph below.

Market cap range: €250m – €4bn or in MSCI World Small Cap Index, minimum average daily liquidity of €500k.

We narrow down our investible universe based on a quantitative filtering process. The filter comprises three stages. All our investment ideas are sourced from the results of our filtering process.

- Stage 1 consists of a filtering process which is run automatically on a daily basis. The goal is to get to a selection of stocks that offer the most interesting investment opportunities. The first filter, the investability screen makes the initial selection of the universe of public stocks. This screen filters on market capitalisation, country, data availability and liquidity. The second screen looks for high quality companies and selects only the better half. The third and last is a value screen which filters on the 25% most attractively valued stocks. The combined screens result in around 500 stocks – the top 12.5% of the universe of stocks after screen 1 in terms of quality and value. We extensively validated the added value of these screens with historical back-tests.

- In stage 2 the team applies its research skills on the securities that remain. The team uses a two-step process to efficiently find new portfolio candidates. The first step is called the ‘Quick Scan’ which serves as the initial research on a stock. After passing the Quick Scan phase a more detailed Fundamental Analysis is done on the company/stock. Our investment cases consist of the company description, the core of the investment case, the main risk factors and ten key building blocks. The building blocks consist of the Porter’s 5 Forces plus an analysis of the Alignment, Strategy, Operations, ESG profile and the Capital Allocation strategy (latter five scores can be viewed as a Management Score) of the company. Each building block gets a score from 1 to 5 (5 being the highest) and the sum of the scores provides the Quality score of a company.

- Stage 3 is the portfolio management phase which includes portfolio construction, portfolio monitoring and risk management. The outcome of the investment process is a diversified portfolio holding between 60 – 90 stocks.

Quantilia: When investing in small-cap size equities, you can quickly be exposed to several other factors like momentum, quality, value, etc. How do you cover this type of factor risk?

Kempen Capital Management: Nobel Laureate Eugene Fama and Kenneth French found that small-cap and value stocks with lower price-to-book ratios have outperformed the broader market over longer time periods. In other words, value tends to outperform growth over the long haul, while small beats large. The Kempen Global Small-cap strategy, by definition, captures this latter factor.

Given our investment approach, we have a ‘value tilt’ in our portfolio. Value investing is not about just selecting cheap stocks; in practice we seek for a margin of safety between the price we pay and the intrinsic value of a company. We put in extra research efforts to ensure ourselves of the quality of a company and its management team.

Sustainable guidelines and ESG standards

Quantilia: More and more institutions set sustainable guidelines when it comes to Investing and Portfolio Management. How do Kempen address this? What future do you foresee for ESG?

Kempen Capital Management: Investing in companies that take their corporate responsibility seriously underpins one of our fundamental beliefs. Our investments comply with generally accepted ESG standards. Kempen bases its criteria for responsible investment on international conventions. The United Nations Global Compact and the Principles for Responsible Investment (PRI) which Kempen both signed, are the foundation of Kempen’s ‘Convention Library’.

Inside our own organisation, we further embedded environmental, social and governance factors into all our investment processes, launched a new policy framework to govern sector exclusions, and implemented an ESG scoring and monitoring framework for investment funds. We also linked ESG integration and active ownership to the key performance indicators of our portfolio managers.

Further afield, we conducted 91 direct engagements and 208 collaborative engagements with leading global companies in 2018. Our engagement efforts were focused on material issues such as climate change, corporate lobbying, human rights, elimination of controversial working conditions in supply chains and the payment of living wages.

Throughout last year and into 2020 we expect continued increased in ESG investment and development for the foreseeable future.

Collaboration with a Fintech like Quantilia

Kempen Capital Management:Fintech companies are emerging across the financial industry. It is good to see them tackling problems the industry has faced for a long time now. Where they can have significant added value is in their flexibility to adapt quickly in an ever faster changing world. The ones really working with a strong focus on a key problem to investors are the ones that are going to excel. Data is becoming increasingly powerful and the players that ride that wave best are the ones set to drive change.

Quantilia allows investment researchers to do even better research into their portfolios which we encourage. Investment portfolios are much more than a selected number of investment funds. We support further transparency for investors to allow them to invest in the best companies that are set to survive in the long term.

About Kempen Capital Management

Quantilia: Kempen Capital Management is quite a unique group. What is the story of this company? How did you get there?

Kempen Capital Management: The year is 1903 and the Amsterdam stock exchange opens its doors in the form of ‘De Beurs van Berlage’ (Berlage’s stock market). Very much like the coming of the worldwide web, this seemingly insignificant event soon becomes a milestone in global history and a game changer in worldwide trade.

In the century that follows, Kempen & Co very modestly gains fame as both an innovative company and a highly trustworthy operation with a unique style of conduct. It comes up with the first securities research publication almost by accident, and in doing so invents the profession of the research analyst. In the latter half of the century, it fine-tunes its signature long-term participation and starts a highly involved style of shareholding.

Kempen & Co cannot help but attract the interest of major foreign players in the field. As it steered closer towards the turn of the millennium, the Kempen ship sailed under numerous (international) flags. That is, until it becomes an independent department of the Van Lanschot Group in 2007.

Today our philosophy at Kempen is to be exclusive rather than ‘all over the place’. So, whilst we are non-existent in some areas, we hold serious clout in others. The result is a clear portfolio that guarantees that all clients receive the same signature “high-level attention” that is synonymous with the brand.

From the “30-years-in-the-business” senior manager to the excited trainee with a head full of ideas, our collective expertise keeps us on par with our clients’ specialised enterprises and enables us to be an important part of the conversation.

Portfolio managers

The Global Small-cap team is an experienced team of four senior portfolio managers with complementary skills and backgrounds. Between them, they cover specific sectors and contribute to the investment process and the selection of stocks for the portfolios. At Kempen, the role of analyst and portfolio manager is combined, which means that all team members both have analytical as well as portfolio management responsibilities, and team members actively discuss and challenge each other about investment opportunities.

Jan Willem Berghuis, Head of Team – began his career at Kempen in 2008 as a Senior Portfolio Manager.

Jan Willem Berghuis, Head of Team – began his career at Kempen in 2008 as a Senior Portfolio Manager.

Prior to the launch of the strategy, Jan Willem was one of the Portfolio Managers for Kempen’s Dutch small-cap strategies (2008 – 2014).

Before this, Jan Willem worked for 9 years as a sell-side Analyst for Kempen Securities.

He holds a Master of Science degree in Applied Physics from the University of Groningen and is a CFA charter holder.

– Joined Kempen in 1999

– Team member since July 2014 (inception)

– Professional experience since 1999

– Sectors: Financials, Healthcare

– Background: Small-caps research and portfolio management

Maarten Vankan, Senior Portfolio Manager – began his career at Kempen as a Senior Portfolio Manager in 2014. Before joining Kempen, he worked for 7 years as a Portfolio Manager / Analyst for Cyrte Investments, and prior to that, as a Portfolio Manager for Aegon Asset Management and for ABN AMRO Asset Management.

Maarten Vankan, Senior Portfolio Manager – began his career at Kempen as a Senior Portfolio Manager in 2014. Before joining Kempen, he worked for 7 years as a Portfolio Manager / Analyst for Cyrte Investments, and prior to that, as a Portfolio Manager for Aegon Asset Management and for ABN AMRO Asset Management.

During his career, his main responsibility has always focused on bottom up investing in the US stock market. He holds a Master of Science degree in Econometrics from the University of Tilburg and is a CFA charter holder.

– Joined Kempen in 2014

– Team member since July 2014 (inception)

– Professional experience since 1999

– Sectors: Consumer Discretionary, Consumer Staples, Technology

– Background: International equity and portfolio management

Chris Kaashoek, Senior Portfolio Manager – joined Kempen in March 2015 as a Senior Portfolio Manager. Chris previously worked as a Business Development Manager at a subsidiary of HAL Investments. At HAL Chris was responsible for managing a private equity portfolio of industrials companies. Chris started his career as an equity analyst with Kempen Securities. He holds a Master of Science degree in Investment Analysis from the University of Tilburg.

Chris Kaashoek, Senior Portfolio Manager – joined Kempen in March 2015 as a Senior Portfolio Manager. Chris previously worked as a Business Development Manager at a subsidiary of HAL Investments. At HAL Chris was responsible for managing a private equity portfolio of industrials companies. Chris started his career as an equity analyst with Kempen Securities. He holds a Master of Science degree in Investment Analysis from the University of Tilburg.

– Re-joined Kempen in 2015

– Team member since March 2015,

– Professional experience since 2006

– Sectors: Industrials, Materials

– Background: Small-caps research and private equity investing

Luuk Jagtenberg, Portfolio Manager – started his career at Kempen in 2012 as an Investment Strategist in the Allocation Team.

Luuk Jagtenberg, Portfolio Manager – started his career at Kempen in 2012 as an Investment Strategist in the Allocation Team.

He joined the Global Small-cap Team as a Portfolio Manager as of November 2015. He holds a Master of Science degree in Finance from the Vrije Universiteit Amsterdam and is a CFA charter holder.

– Joined Kempen in 2012

– Team member since November 2015

– Experience since 2012

– Sectors: Energy

– Background: Investment strategy

Portfolio management is a people-based business. We believe in a team-based approach where team members are complementary and challenge each other. We are passionate about our strategy and would like to see passion at the companies we invest in. The Portfolio Managers co-invest in the strategy.