PENSION FUNDS & INSTITUTIONS

Take portfolio management & decision making to the next level

Tailored platforms dedicated your exact specificities

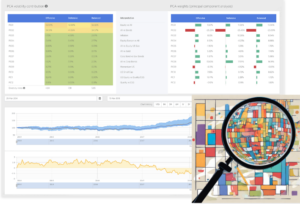

Pension funds, sovereign wealth funds and endowments are more than ever seeking transparency in their investments as well as easy access to pertinent data. Our independent and secured platform connects your teams directly with all your relevant data sources: custodian banks, asset managers, credit or ESG rating agencies, benchmarks, exclusion lists, research, etc... Leverage on a wide spectrum of performance and risk analyses, which you can implement with your own metrics and conventions, at a position, portfolio or sub-portfolio level.

With dedicated accounts for each type of user, bring the right analysis and document to the right person, on time and in the right format.

Quantilia as a trustful partner

Free from conflicts of interest, Quantilia is dedicated to meeting the sophisticated visualization needs and demands for transparency of its users. Beyond merely offering tools, Quantilia stands alongside its users throughout their decision-making and portfolio management journeys, equipping them with essential analytics and instruments to maintain clarity of vision. The company's organizational structure and capital framework further underscore its commitment to independence, ensuring that user interests remain paramount and free from any potential conflicts. By choosing Quantilia, users gain access to a platform that prioritizes integrity, transparency, and user-centricity, empowering them to navigate the complexities of investment management with confidence and assurance.

Access a world of data science

At Quantilia, our mission is to provide comprehensive support throughout every stage of portfolio creation and monitoring, aligning with your investment objectives through the utilization of cutting-edge machine learning and big data technology. Leveraging the power of advanced programming, our team of specialists curates a comprehensive library of insights to assist you in various aspects of portfolio management. From portfolio construction to back-testing and stress testing, we offer multidimensional simulations that allow you to explore different parameters as well as enhanced data services. Our use of artificial intelligence (AI) is integral to our daily operations, aiding in data categorization, checks, and analysis. However, human oversight remains a crucial component, ensuring the accuracy and quality of the data and analyses provided. By combining the efficiency of AI with the expertise of our team, Quantilia delivers a platform that empowers you to make informed decisions and optimize your investment strategies with confidence and precision.

Discover Clustering SolutionsDedicated to institutions

At Quantilia, our commitment extends beyond geographical boundaries as we collaborate with institutional investors. From our inception, we have partnered with numerous sovereign wealth funds and pension funds, providing them with innovative solutions to navigate their multifaceted challenges across the globe. Our extensive track record speaks for itself, with a diverse client base that spans continents and industries. If you require references, we are proud to share testimonials from our existing clients, many of whom represent some of the largest institutions in Europe. Currently, our platform monitors assets totaling over 100 billion EUR across various asset classes for these esteemed clients. This breadth of experience and scope underscores our ability to deliver comprehensive solutions that meet the diverse needs of institutional investors on a global scale. At Quantilia, we are dedicated to fostering long-term partnerships and empowering our clients to achieve their investment objectives with confidence and clarity.

Quantilia Lookthrough SolutionsFlexible and exclusive

At Quantilia, we understand that each institutional investor is unique, with distinct investment preferences, strategies, and objectives. That's why our platform is designed to cater to your specific needs, interests, styles, and choices. Whether you have a preference for illiquid assets, impact investing, or other specialized areas, we offer tailored solutions that align with your investment habits and preferences. Our platform provides access to specific content that is customized to meet your requirements, ensuring that you have access to the most relevant investment solutions for your portfolio strategy. With a focus on customization, scalability, and differentiation, our solutions are adaptable to your evolving needs and can accommodate changes in your investment approach over time. By offering personalized and flexible solutions, Quantilia empowers you to make informed decisions and optimize your investment outcomes with confidence and precision.