INSURANCE COMPANIES

Reliable data and portfolio services

Rely on robust data processing and portfolio analyses services

At Quantilia, we go above and beyond to meet the unique needs of insurance companies by offering comprehensive data processing and portfolio analysis services. With our meticulous attention to detail, insurance companies can trust that their data is processed with the utmost precision and reliability. Moreover, our platform enables seamless communication with asset managers, allowing for timely discussions and resolution of any discrepancies that may arise. By leveraging Quantilia's advanced analytics and expert support, insurance companies can optimize their investment portfolios with confidence, knowing that they have access to accurate data and actionable insights. Count on Quantilia to be your trusted partner in insurance portfolio management, delivering unparalleled reliability and performance every step of the way.

TPT, EET, EPT and other types of files

At Quantilia, we specialize in collecting and processing various types of files, including TPT, EET, EPT, and others, to provide insurance companies with comprehensive portfolio analysis solutions. With our robust data processing capabilities, we conduct thorough checks on each file, performing more than 600 quality assurance checks to ensure data accuracy and integrity. Our team is dedicated to maintaining the highest standards of data quality, leveraging advanced algorithms and technology to meticulously validate and cleanse the data. Additionally, we serve as a liaison between insurance companies and asset managers, facilitating transparent communication and ensuring timely resolution of any discrepancies or issues that may arise. With Quantilia, insurance companies can trust that their data is in good hands, allowing them to make informed investment decisions with confidence and clarity.

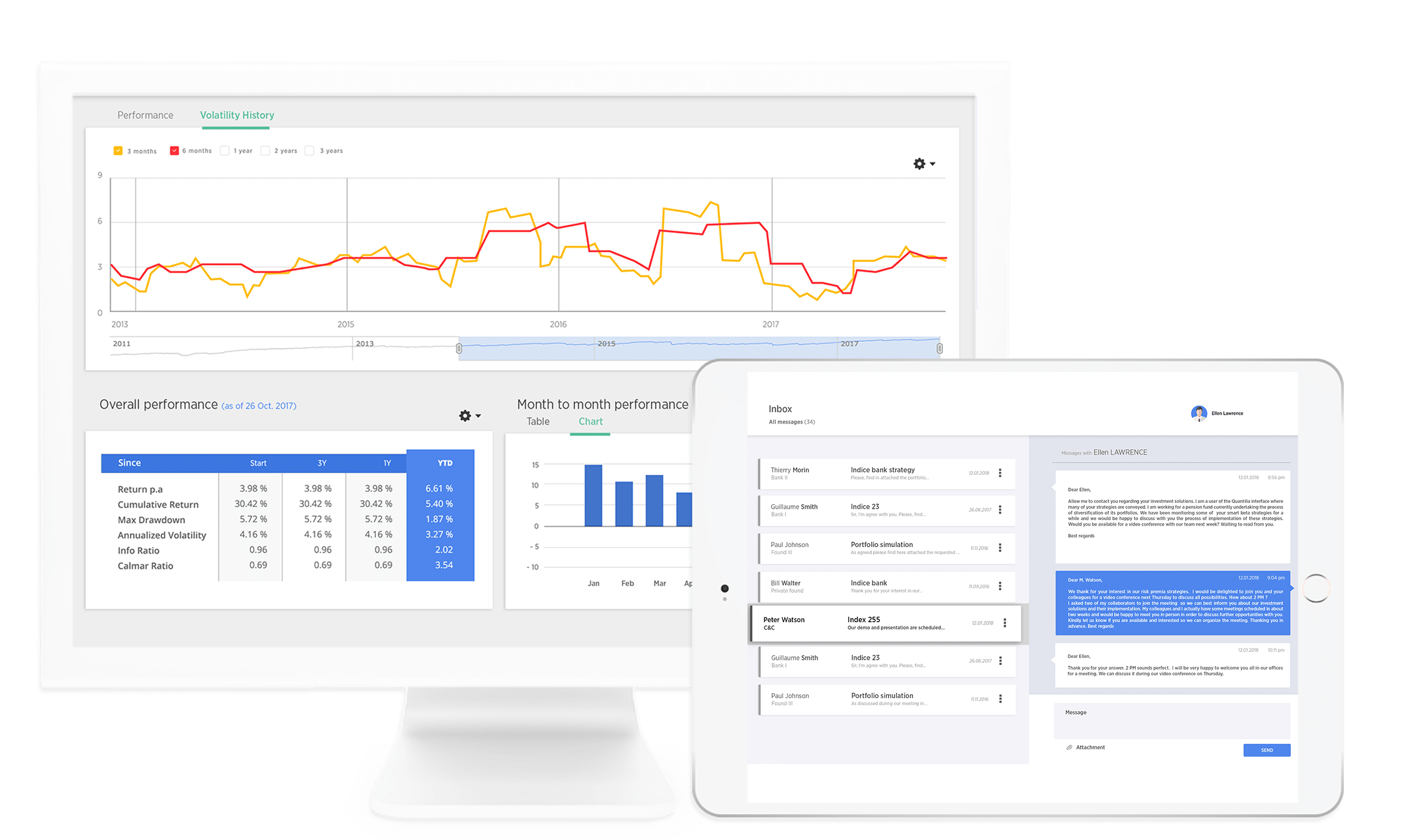

Our data management platform

Bespoke ESG analyses

At Quantilia, we understand the growing importance of Environmental, Social, and Governance (ESG) considerations in the insurance industry. That's why we offer comprehensive solutions for the production of ESG reports tailored specifically to the needs of insurance companies. Our process begins with the collection of funds inventories, where we gather data on the underlying assets in the insurance company's investment portfolio. We then integrate ESG data from various providers, ensuring a holistic view of the sustainability performance of the portfolio holdings. Our team works closely with insurance companies to tailor ESG methodologies that align with their specific objectives and preferences. Whether it's incorporating exclusionary screens, applying ESG scoring models, or assessing climate-related risks, we customize our approach to meet the unique needs of each client. Additionally, we generate a wide range of reports, including regulatory disclosures such as LEC29, PAI and SFDR, as well as stakeholder and client-facing reports that showcase the insurance company's commitment to responsible investing. With Quantilia, insurance companies can leverage ESG reporting as a strategic tool to enhance transparency, mitigate risks, and meet the evolving expectations of regulators, stakeholders, and clients alike.

ESG and legal reports

Illiquid Assets and Private Equity

At Quantilia, our comprehensive cross-asset platform is equipped to provide extensive support for all your private equity and illiquid asset positions. We understand the unique challenges associated with managing these types of investments and offer tailored solutions to address them effectively. Our platform facilitates the collection of Environmental, Social, and Governance (ESG) information from both funds and companies, enabling insurance companies to assess the sustainability performance of their investment portfolios. Additionally, we specialize in processing funds reports to extract valuable information, such as performance metrics, risk factors, and fee structures, allowing insurance companies to gain deeper insights into their investments. Furthermore, our platform offers sophisticated liquidity analysis tools, enabling insurance companies to optimize their cash reserves and ensure they can meet their financial obligations while maximizing returns. By leveraging Quantilia's advanced capabilities, insurance companies can enhance their investment decision-making processes, mitigate risks, and achieve their financial objectives with confidence and precision. Trust Quantilia to be your trusted partner in navigating the complexities of private equity and illiquid asset management, delivering actionable insights and innovative solutions tailored to your specific needs.

Private Equity and Illiquid Assets

Flexibile data services

In today's rapidly evolving financial landscape, the ability to tailor services to meet the unique needs of each client is essential. At Quantilia, we understand that every organization has its own set of requirements, preferences, and existing setups. That's why we are committed to adjusting our services to align seamlessly with what you really need, ensuring a seamless integration with your existing workflows and systems.

One of the key ways we accomplish this is by leveraging our flexible reporting capabilities. Whether you prefer ready-to-send reports that are fully customized to your specifications, or you prefer to integrate our data directly into your internal systems via an API, we have you covered. Our platform is designed to adapt to your preferences, allowing you to choose the method that works best for you.

For those who require ready-to-send reports, our team can create bespoke reports that are tailored to your specific requirements. Whether you need performance reports, risk assessments, or compliance documentation, we can deliver professionally designed reports that meet your exact specifications. These reports can be generated on-demand or on a recurring basis, ensuring that you always have access to the information you need, when you need it.

Alternatively, if you prefer to integrate our data directly into your internal systems, we offer seamless API integration that allows you to automate the process of data ingestion and report generation. By connecting our platform to your existing systems, you can streamline your workflows, reduce manual effort, and ensure data consistency and accuracy across your organization.

Ultimately, our goal at Quantilia is to provide you with the flexibility and customization you need to achieve your objectives. Whether you require ready-to-send reports or seamless API integration, we will work closely with you to ensure that our services align perfectly with your existing setup requirements. With Quantilia, you can trust that you will receive tailored solutions that meet your needs and exceed your expectations.