ASSET MANAGERS

Focus on your core business while we take care of the rest

The platform

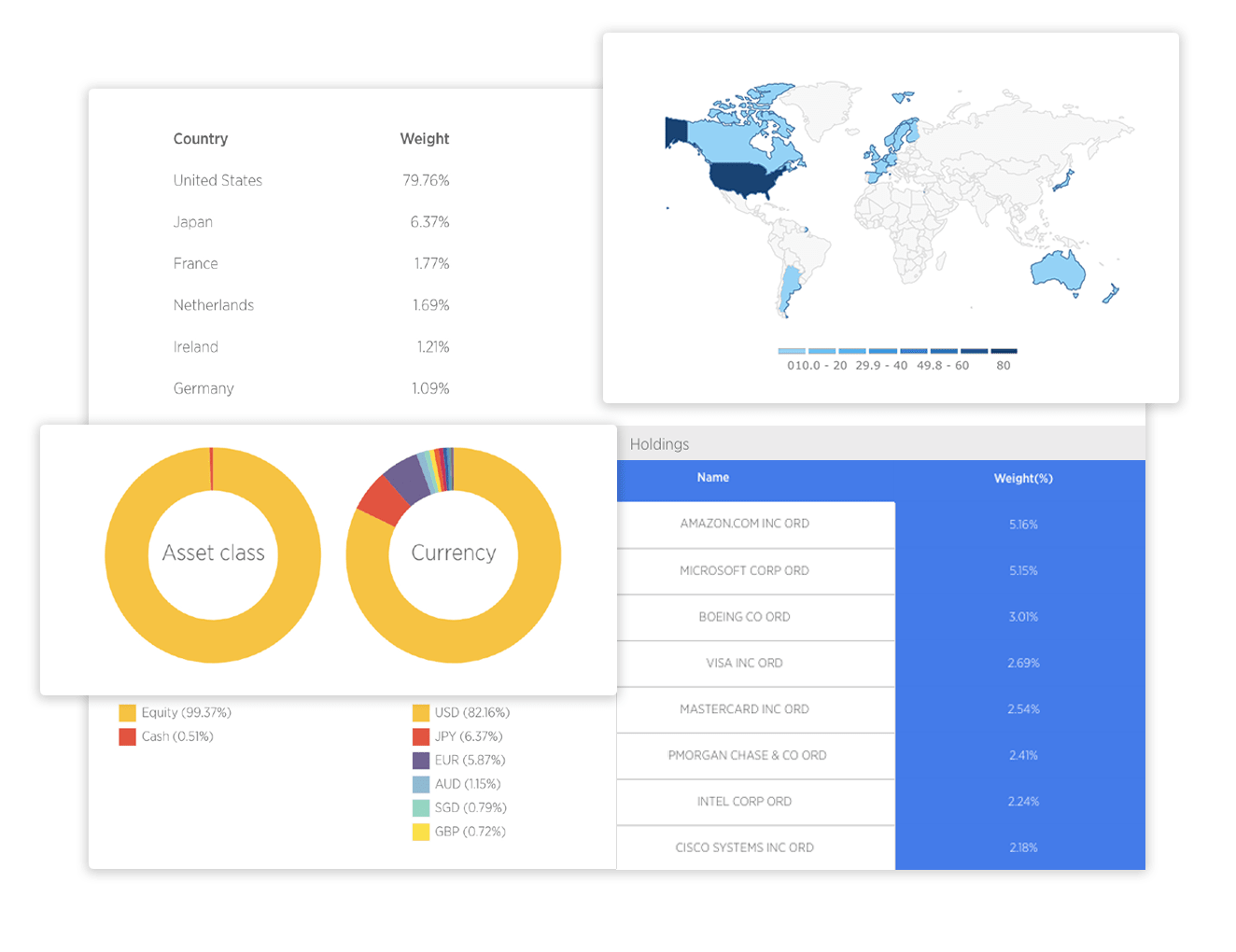

Quantilia is offering you a platform where to convey in a crystal clear manner investment solutions. Increase your visibility towards a qualified target of institutional investors and instantaneously grow your business leads and revenues. Our teams of experts developed a dynamic, secured and out-of-the-box platform where thousands of strategies and funds are listed, and where players in the international financial markets can directly engage with each other in order to increase their market shares.

Dedicated services

At Quantilia, our dedicated team of data analysts is committed to supporting asset managers in maximizing the efficiency of their teams and resources. By outsourcing time-consuming reporting and monitoring services to Quantilia, asset managers can focus on strategic decision-making and value-added activities. Our team takes a dual approach to support our clients: firstly, we collect and organize relevant data tailored to the specific needs of each organization. This includes gathering data from various sources, ensuring its accuracy and completeness, and organizing it in a format that is easily accessible and usable for analysis. Secondly, we provide a wide spectrum of sophisticated analytics and calculations to help asset managers perform the analysis they need. Whether it's advanced risk modeling, performance attribution, or portfolio optimization, our team leverages cutting-edge tools and techniques to deliver actionable insights. Additionally, we understand the importance of timeliness and accuracy in data delivery. Therefore, we ensure that our clients receive the right data in the right format, precisely when they need it. By partnering with Quantilia, asset managers can leverage our expertise and resources to enhance their analytical capabilities, drive informed decision-making, and achieve their investment objectives with confidence and precision.

Lookthrough and ESG services

As fund of funds managers, you face the complex task of processing funds inventories and conducting detailed analysis at the issuer level, particularly for purposes such as Environmental, Social, and Governance (ESG) assessment or liquidity management. At Quantilia, we recognize the challenges associated with these responsibilities and are committed to providing comprehensive solutions to support fund of funds managers in their endeavors. Our leading security level lookthrough service allows you to gain a granular understanding of your portfolio holdings, enabling you to analyze investments at the issuer level with precision and accuracy. Moreover, our platform boasts the capability to seamlessly integrate ESG or financial data, empowering you to evaluate the sustainability and performance characteristics of your investments. Additionally, we offer expertise in creating legal reports, ensuring compliance with regulatory frameworks such as SFDR (Sustainable Finance Disclosure Regulation) and LEC29, as well as generating client reports tailored to your specific requirements. By partnering with Quantilia, fund of funds managers can leverage our advanced tools, comprehensive data coverage, and regulatory expertise to streamline operations, enhance decision-making processes, and ultimately deliver superior outcomes for their clients.

Quantilia Lookthrough Services

Collection of documents and files

As an asset manager, the process of gathering and organizing documents from various partners can often be time-consuming and labor-intensive. At Quantilia, we recognize the importance of streamlining this process for our clients. Our platform offers comprehensive document management services, taking care of the collection, filtration, and preparation of datasets on your behalf. We handle the tedious task of gathering documents from your partners, ensuring that all relevant information is collected promptly and efficiently. Additionally, our team meticulously filters and prepares the datasets, ensuring that they are organized and formatted correctly before being sent to you. By entrusting Quantilia with your document management needs, you can save valuable time and resources, allowing you to focus on more strategic aspects of your asset management responsibilities. With our efficient and reliable document management services, you can rest assured that you have access to the information you need, when you need it, in the right format, empowering you to make informed decisions and drive portfolio performance with confidence.

Data Services

Quantilia as a bridge between your solutions and your clients

At Quantilia, we empower large investors to navigate the intricacies of complex investment solutions and determine their suitability within their portfolios. Our platform provides the tools and insights necessary to conduct objective and efficient analysis tailored to the unique context of your clients' portfolios. Whether evaluating alternative investment strategies, assessing risk factors, or optimizing asset allocations, Quantilia offers a comprehensive suite of analytical capabilities to support informed decision-making.

Moreover, Quantilia serves as a valuable communication channel for engaging with institutional investors, family offices, and private banks. Through our platform, you can leverage data-driven analysis to facilitate fruitful and effective communication with your clients. By presenting transparent and actionable insights, you can strengthen client relationships, build trust, and enhance collaboration. Additionally, Quantilia offers customizable reporting features, allowing you to deliver tailored presentations and reports that resonate with your clients' specific needs and preferences.

By utilizing Quantilia as a strategic partner, large investors can leverage our platform to not only enhance their analytical capabilities but also to foster meaningful and productive interactions with their clients. With our commitment to innovation, transparency, and client-centricity, Quantilia empowers investors to unlock new opportunities, drive growth, and achieve their investment objectives with confidence and clarity.