USE CASES

ESG & IMPACT INVESTING

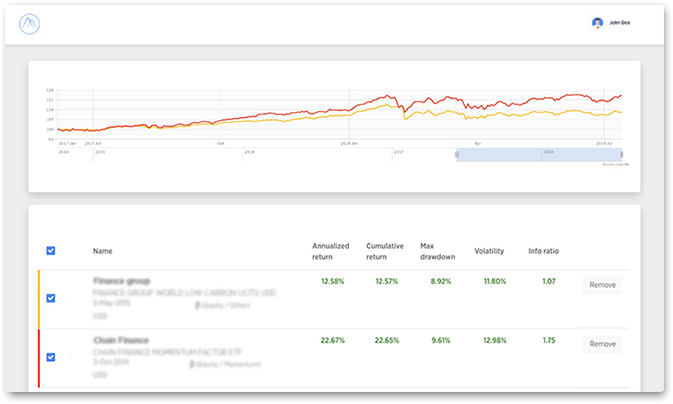

Combine financial performance with impact investing

An ever-growing interest

Environmental, social and governance investing has grown by more than 97% in the past 20 years, reaching hundreds of trillions all around the globe. In the mean time, new regulations have come up at the EU level to accompany the investor journey toward ESG and impact investing, with EU taxonomy for sustainable activities and SFDR among others.

At Quantilia, we see sustainability as a value driver and a long-term force for change in markets, countries and companies. We accompany ESG focused investors on their journey to strengthen and diversify their portfolios and make these values the core of their business by providing them with the most valuable data.

ESG is all about data

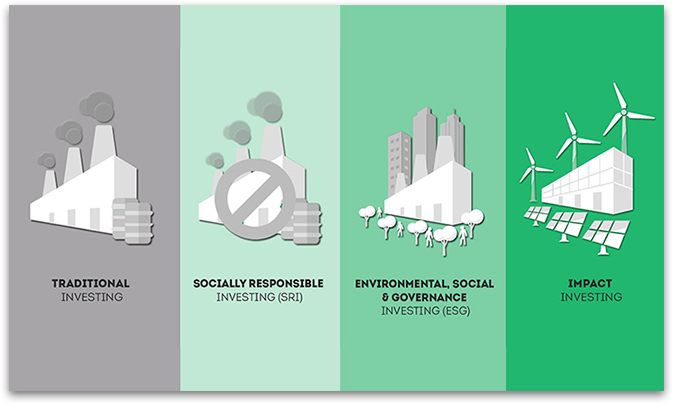

In recent years, Environmental, Social, and Governance (ESG) considerations have become increasingly important for investors seeking to align their portfolios with sustainability goals and ethical principles. As the demand for ESG services continues to grow, the need for accurate and reliable data has never been more crucial. Without access to high-quality data, investors may struggle to effectively assess the ESG performance of their portfolios, leading to suboptimal investment decisions and missed opportunities for positive impact.

Accurate data is the foundation upon which ESG services are built. It serves as the raw material from which insights are derived and decisions are made. However, sourcing and analyzing ESG data can be a complex and time-consuming process, particularly given the vast amount of information available and the varying standards and methodologies used by different data providers.

This is where Quantilia comes in. As a leading provider of data services, Quantilia is uniquely positioned to meet the growing demand for accurate and reliable ESG data. Our platform offers a comprehensive suite of tools and analytics designed to streamline the process of collecting, analyzing, and reporting on ESG metrics.

One of the key advantages of Quantilia is our ability to aggregate data from a wide range of sources, including proprietary databases, third-party providers, and public sources. This allows us to provide investors with a holistic view of ESG performance across their entire portfolios, enabling them to identify trends, assess risks, and make informed decisions.

Moreover, Quantilia's platform is powered by advanced analytics and machine learning algorithms, which enable us to perform sophisticated analyses and generate actionable insights. Whether investors are looking to assess the carbon footprint of their portfolios, evaluate the diversity and inclusiveness of their investments, or measure the social impact of their holdings, Quantilia can provide the tools and expertise needed to achieve their ESG goals.

In addition to our data services, Quantilia also offers customizable reporting solutions, allowing investors to create tailored ESG reports that meet their specific needs and preferences. Whether investors are looking to satisfy regulatory requirements, communicate with stakeholders, or demonstrate their commitment to sustainability, Quantilia can help them create professional-grade reports that showcase their ESG efforts.

In conclusion, the need for accurate data services has never been more critical in the context of ESG investing. With Quantilia, investors can access the high-quality data and sophisticated analytics they need to effectively integrate ESG considerations into their investment processes. By leveraging Quantilia's platform, investors can make more informed decisions, drive positive change, and create value for themselves and society as a whole.

Quantilia Data Services

ESG reports at Quantilia

As the importance of Environmental, Social, and Governance (ESG) factors continues to rise in the investment landscape, regulatory bodies have responded by implementing a range of reporting requirements aimed at promoting transparency and accountability. These regulations span a variety of jurisdictions and cover a wide array of ESG considerations, reflecting the growing recognition of the need for standardized reporting practices to support sustainable investment decision-making.

One such regulation is the Sustainable Finance Disclosure Regulation (SFDR), introduced by the European Union to enhance transparency regarding the ESG characteristics of financial products. SFDR mandates that asset managers and financial advisors disclose certain ESG-related information to investors, including details on their ESG policies, the integration of sustainability risks, and the adverse impacts of investment decisions on sustainability factors.

In addition to SFDR, insurance companies in France must comply with the Loi Energie-Climat (LEC29), which requires them to report on their exposure to climate-related risks and their efforts to transition to a low-carbon economy. Similarly, the Prudential Authority Instructions (PAI) in France mandate that insurers disclose information on their ESG policies, governance structures, and risk management practices.

Furthermore, the European Union's Taxonomy Regulation aims to establish a common framework for classifying economic activities according to their environmental sustainability. Under this regulation, financial market participants must disclose information on the alignment of their investments with the EU Taxonomy criteria, providing investors with clarity on the environmental impact of their portfolios.

Navigating this complex regulatory landscape can be challenging for financial institutions, requiring them to gather and analyze vast amounts of data to ensure compliance with reporting requirements. This is where Quantilia comes in. As a leading provider of data and analytics solutions, Quantilia is well-positioned to support financial institutions in meeting their ESG reporting obligations.

Quantilia's platform offers a comprehensive suite of tools and resources designed to streamline the process of ESG reporting. From data collection and aggregation to analysis and reporting, Quantilia provides financial institutions with the tools they need to efficiently manage their ESG reporting requirements. Moreover, Quantilia's expertise in regulatory compliance ensures that financial institutions can trust the accuracy and reliability of the reports generated by the platform.

In conclusion, the proliferation of ESG reporting requirements underscores the need for robust data and analytics solutions to support sustainable investment practices. With Quantilia, financial institutions can leverage cutting-edge technology and expertise to navigate the complex regulatory landscape and demonstrate their commitment to ESG principles. As a trusted partner to leading institutions in Europe, Quantilia is committed to empowering financial institutions to meet their ESG reporting obligations and drive positive change in the investment industry.

ESG and Legal Reports

Implement your own ESG methodology

In today's dynamic investment landscape, investors are increasingly recognizing the importance of tailoring their Environmental, Social, and Governance (ESG) methodologies to align with their unique investment objectives and preferences. As such, the ability to implement investor-specific ESG methodologies has become a crucial factor in driving informed decision-making and achieving sustainable investment outcomes.

Quantilia is at the forefront of empowering investors to implement their own customized ESG methodologies. With our advanced technology and expertise in data processing, we offer investors the flexibility to define and implement ESG methodologies that are tailored to their specific needs and preferences.

One of the key advantages of partnering with Quantilia is our ability to perform thorough funds lookthrough and integrate data from any ESG rating provider. This allows investors to access a wealth of information on the ESG performance of their portfolios, enabling them to make informed decisions based on accurate and reliable data.

Moreover, Quantilia takes care of the data processing and methodology implementation process, relieving investors of the burden of managing complex data workflows and methodology development. Our platform is equipped with powerful analytics tools and algorithms that enable us to process large volumes of data quickly and efficiently, ensuring that investors have access to timely and accurate information.

By outsourcing data processing and methodology implementation to Quantilia, investors can focus their time and resources on analysis and further developments. This allows them to leverage their expertise and insights to drive continuous improvement in their ESG methodologies and investment strategies, ultimately leading to better outcomes for their portfolios and stakeholders.

In conclusion, the ability to implement investor-specific ESG methodologies is essential for driving sustainable investment practices and achieving long-term value creation. With Quantilia, investors have the tools and support they need to define and implement customized ESG methodologies that align with their unique objectives and preferences. By leveraging our advanced technology and expertise, investors can streamline their ESG analysis processes, enhance their decision-making capabilities, and unlock new opportunities for growth and impact.

Your format, Your design, Our responsibility

In today's fast-paced financial landscape, Environmental, Social, and Governance (ESG) considerations have become increasingly integral to investment decision-making. As investors strive to integrate ESG principles into their portfolios, the need for accurate and reliable reporting has never been more crucial. At Quantilia, we understand the importance of delivering ESG reports that not only meet regulatory requirements but also align with our clients' unique preferences and branding guidelines.

One of the key challenges that investors face when it comes to ESG reporting is ensuring that the format and design of the reports are tailored to their specific needs. While regulatory compliance is essential, so too is the ability to present information in a way that resonates with stakeholders and reflects the organization's brand identity.

That's where Quantilia comes in. Our platform offers a comprehensive suite of tools and resources designed to streamline the ESG reporting process. From data collection and analysis to report generation and distribution, we take care of the entire process, allowing our clients to focus on what matters most: analyzing the insights and making informed decisions.

One of the unique advantages of partnering with Quantilia is our ability to provide ESG reports in the format of our clients' choosing. Whether it's a traditional PDF document, an Excel spreadsheet, a PowerPoint presentation, or data delivered via API, we can accommodate our clients' preferences and ensure that the reports are designed to meet both regulatory requirements and internal branding guidelines.

Moreover, our team of experts works closely with clients to understand their specific formatting and design preferences. Whether it's incorporating company logos and branding elements, customizing color schemes and fonts, or structuring the report layout to highlight key insights, we ensure that every aspect of the report is tailored to our clients' needs.

By offering customizable reporting formats and designs, Quantilia empowers investors to communicate their ESG efforts effectively and transparently. Whether it's presenting reports to regulators, shareholders, or internal stakeholders, our clients can trust that their ESG reports will be delivered in a format that reflects their organization's values and priorities.

In conclusion, with Quantilia, investors can rest assured that their ESG reporting needs are in good hands. From data collection and methodology implementation to report formatting and design, we take responsibility for delivering accurate, reliable, and visually compelling ESG reports that meet our clients' regulatory and branding requirements. With Quantilia, it's your format, your design, and our responsibility.