PRODUCT

DATA COLLECTION, ENRICHMENT, AGGREGATION AND INTEGRATION

The data you need, ready to go

PERFORMANCE AND RISK ANALYTICS

Quantilia helps you achieve high-precision investment opportunities and improve your performances with a pre-configured online data and portfolio management engine containing everything you need to build, test and run your portfolio. With its complete range of analytics, find in one place your performance, risks or factor reports in an actionable format.

PERFORMANCE AND RISK ANALYTICS

Quantilia helps you achieve high-precision investment opportunities and improve your performances with a pre-configured online data and portfolio management engine containing everything you need to build, test and run your portfolio. With its complete range of analytics, find in one place your performance, risks or factor reports in an actionable format.

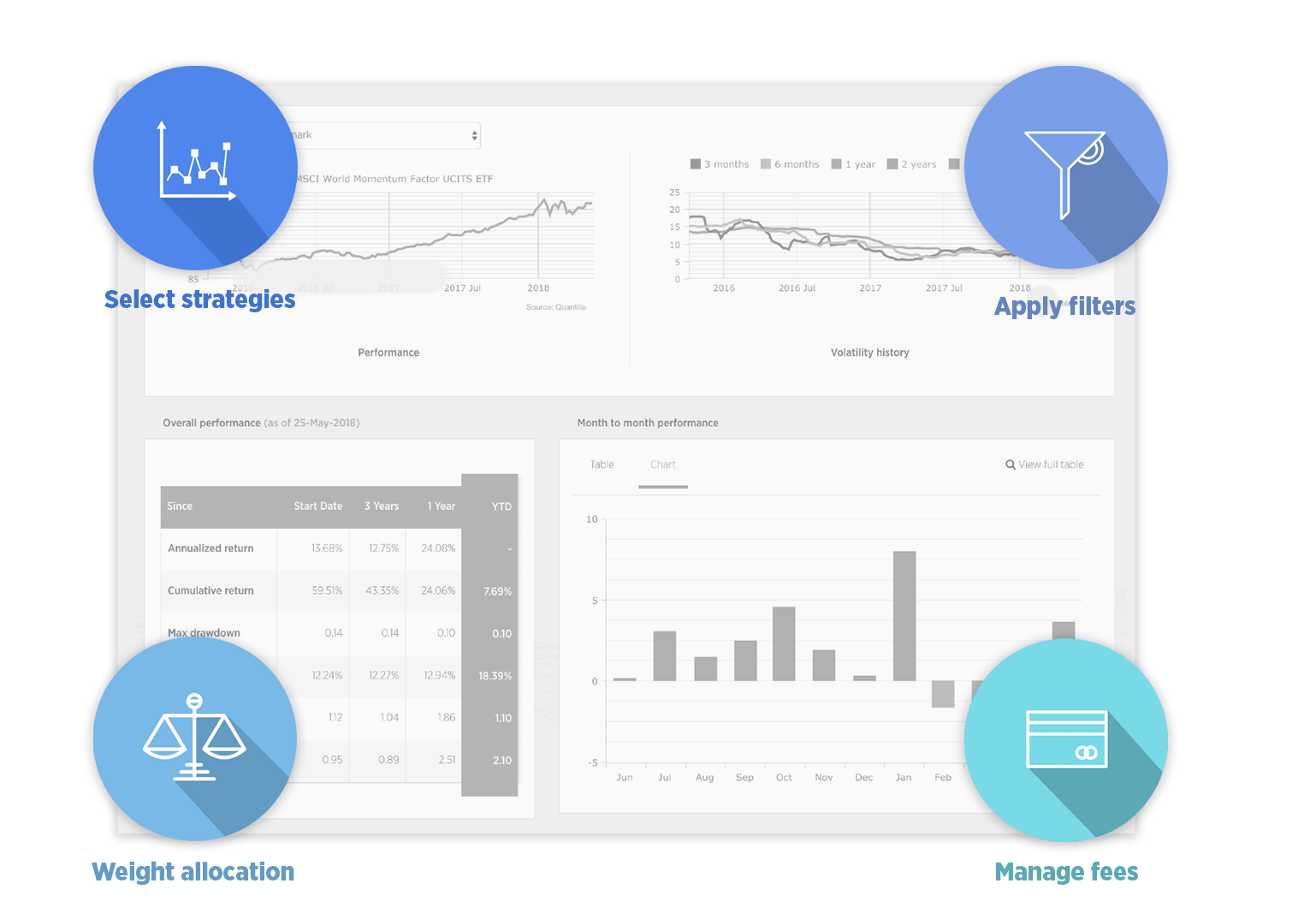

PERFORMANCE ANALYSIS

With Quantilia Performance Analysis report, you will get an up-to-date, accurate, ready-to-use view of your portfolio achievements at any time. Figure out the winning and losing trades, your investment bias and analyse the various performance contributors. Classify the information by country, sector, asset class or any specific internal metrics and access to an exact view of aggregated dividends, fees or coupon payments. Benefit from enhanced visualisation tools with state-of-the-art charts and diagrams, customised dashboards to see the data you need the way you want. The platform also allows you to generate your own regulatory and marketing reports with a clean layout that includes all the information you need.

Get started

RISKS AND FACTORS

Quantilia gives you an instant visual feedback to assess your portfolio’s risks and run daily automated computations. Analyse the risk in volatility, Value at Risk, expected shortfall or other risk metrics, and get a Principal Component Analysis and detailed factor analysis describing your portfolio key drivers. Assess the diversification of your portfolio with relative, marginal and absolute measurements, and test alternatives to build the most balanced set of positions.

Talk to our experts

PORTFOLIO CONSTRUCTION

Quantilia gives you full control of all parameters that enter into the construction of your basket, such as rebalancing frequency and weighting schemes. Its multidimensional simulations and stress test module will help you confirm the stability of your model and optimise your performances. The platform also enables the usage of statistics, risk metrics, factor analysis (momentum, value, carry, size, growth, etc.), ESG scores, the comparison of live and stress-test behaviours and the comparison of different strategies. You can create defensive and offensive profiles, compare different allocations such as SAA and TAA. The platform also includes parameters to run peer, redundancy and loophole analyses, ESG (environmental, social, governance) criteria and principal component analysis (PCA).