Asset consolidation

Banks, funds and financial data consolidation

Connect directly with all your custodian banks, asset managers, private equity funds, benchmarks, ESG or credit ratings providers. Get security level reports, enriched issuers data and gather your liquid and illiquid assets in the same place. No data source will be left aside, as you can incorporate easily into your account all your partners data, irrespective of the format they use or their level of IT maturity.

Every piece of data undergoes meticulous categorisation, thorough cleaning, homogenisation, and meticulous preparation for analysis. Our commitment to data integrity and quality means that you can trust the insights derived from our platform to be accurate, reliable, and actionable.

ESG and risk analysis

Sustainable and performing investments

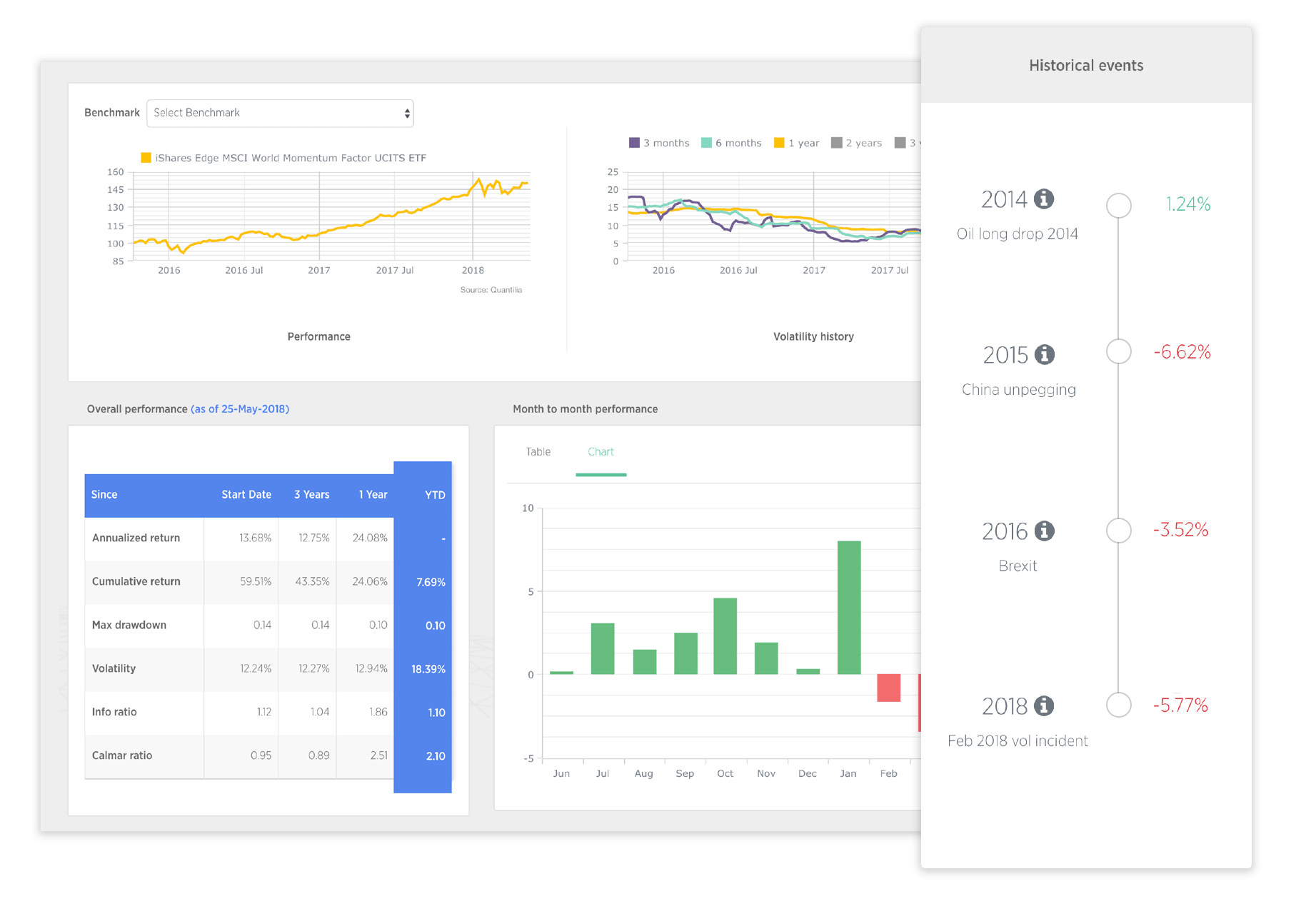

Take charge of your ESG data management, elevate your sustainability strategies to new heights, and streamline collaboration through enhanced ESG processes, even in the context of funds of funds or diversified portfolios. Integrate accurate risk analysis dimensions into your portfolio analysis for more comprehensive insights and informed decision-making.

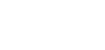

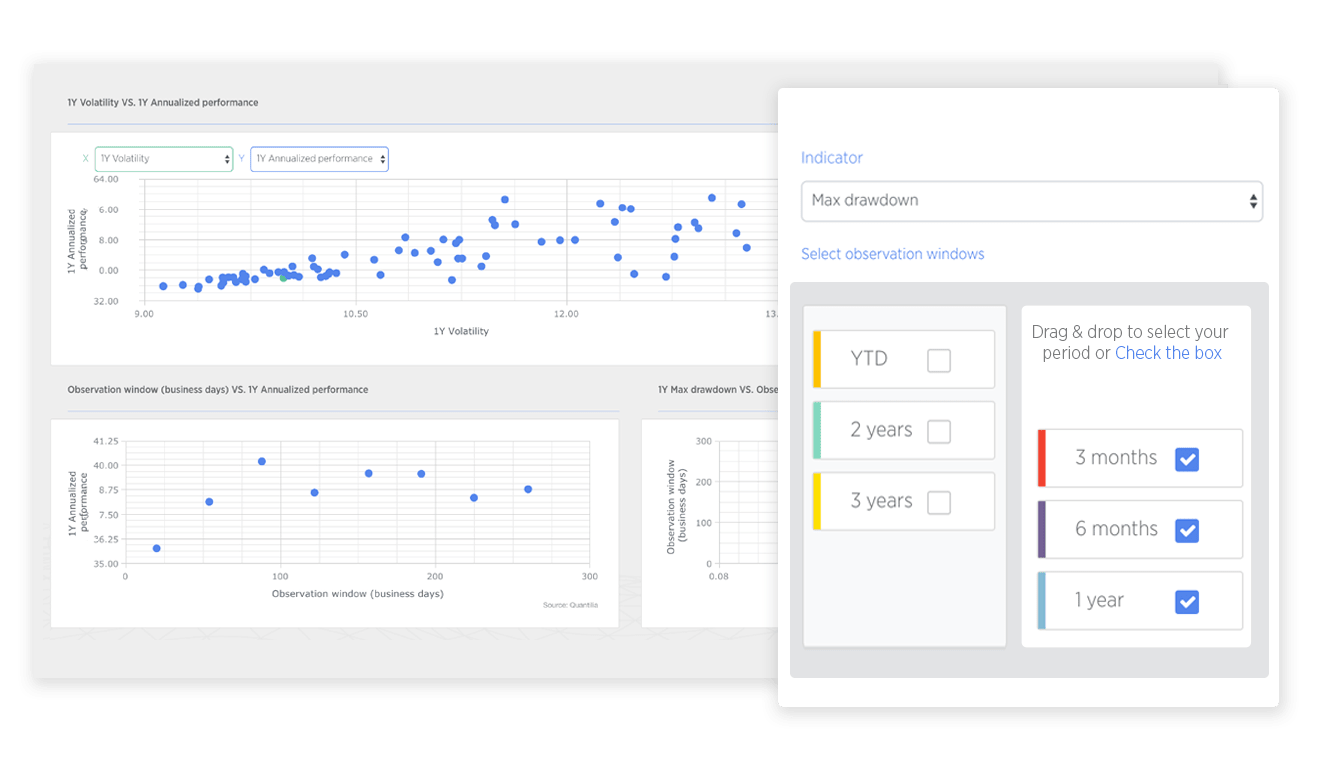

Slash the time needed to analyse, exploit and categorize data. Benefit from enhanced visualisation tools with custom made display suited to each team and organisation, from portfolio managers to risk analysts.

Cross-asset portfolio analytics

Private Equity, Real Estate, direct participations, infrastructure, derivatives, art,...

Onboard all the assets of your portfolio, including private equity, real estate, private debt or infrastructure, and this for any instrument type, like derivatives, funds and private mandates. Monitor your positions at the portfolio level, or dig into one specific asset class thanks to dedicated modules.

Benefit from tailored views and analysis, enabling you to re-discover your portfolio with the conventions, hierarchies and priorities which matter most to you.

250K

assets mapped

135B+ assets under reporting (USD)

400+ connections with banks, AMs and sources

35+ active clients