Today, while some are waiting for the federal reserve’s rates decision, other closely observe any possible economic fallout from the summit between president Trump and the North Korean president.

Investors worldwide continue to monitor the international political, economic and financial events to understand and seize the best investment opportunities during these times of turmoil, and it reflects clearly on the international markets.

For a global and clear-sighted view of the market, we analyzed the performance of different strategies across sectors and countries.

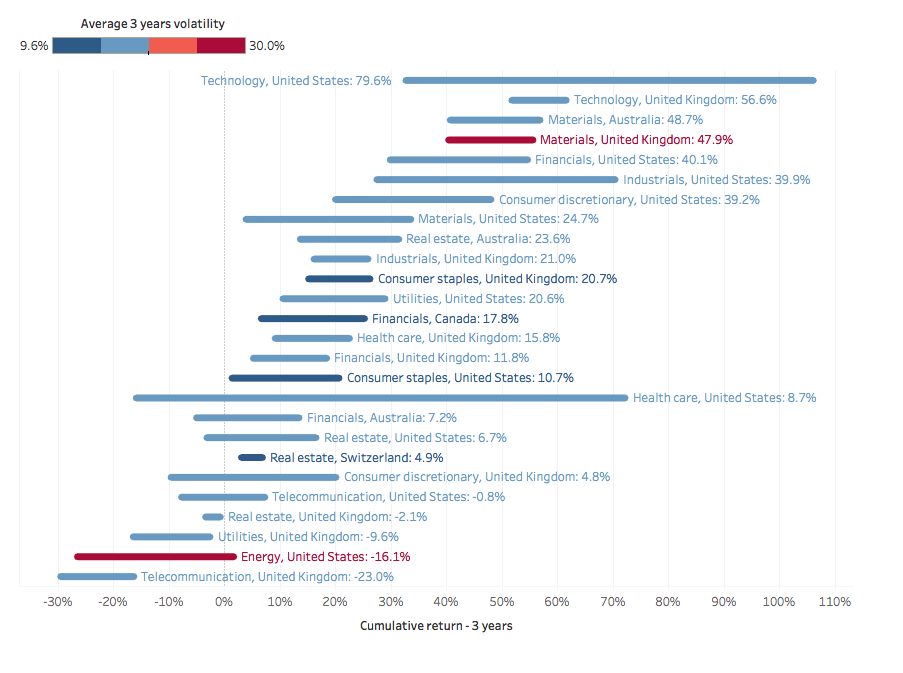

The graph above represents the cumulative 3 years return of 155 strategies sorted by 26 sector and country combinations. The length of each lines represents the range of the cumulative return between the top strategy and the lowest one, meaning that the longest the line, the biggest the gap between strategies.

The performance of the same sectors varies considerably according to the geographical zone since global markets tend to be easily influenced by different international matters of various natures such as major elections and referendums (Italy, Germany, US, Brexit), economic instability, political turmoil etc.

It can clearly be seen how the technology sectors outperformed the market by a large margin in both the United States and the United Kingdom. According to different market analysts, the excitement around the IT industry came because of the signs of turbulence showed by the global economy and the fear of the damages caused by the trade wars the United States engaged in during 2018. Investors keep looking for a consistent source of positive performance and it happens to be the technology sector. Indeed, since the beginning of the year, a total amount of $10.2 billion was invested in it, with almost half of the amount into ETFs tracking technology in May 2018 alone.

As a result, the sector in the United States have seen its stocks go up over 0.3% in the S&P 500 this Tuesday and reports indicate it has rose 3.94% in S&P 500 and 13.56% in Dow Jones year-to-date.

On the other hand, energy has performed negatively in the US with a three years cumulative return of -16.1% combined with high volatility remaining a complex and uncertain sector to invest in worldwide. In the UK, oil and gas make up for more than 15% of the FTSE 100.

With these results in mind, we can’t help but think what are the best sectors to invest in? Is an intra-regional approach for allocations the best solutions?

For more detailed data, check our quantitative investment platform by clicking here