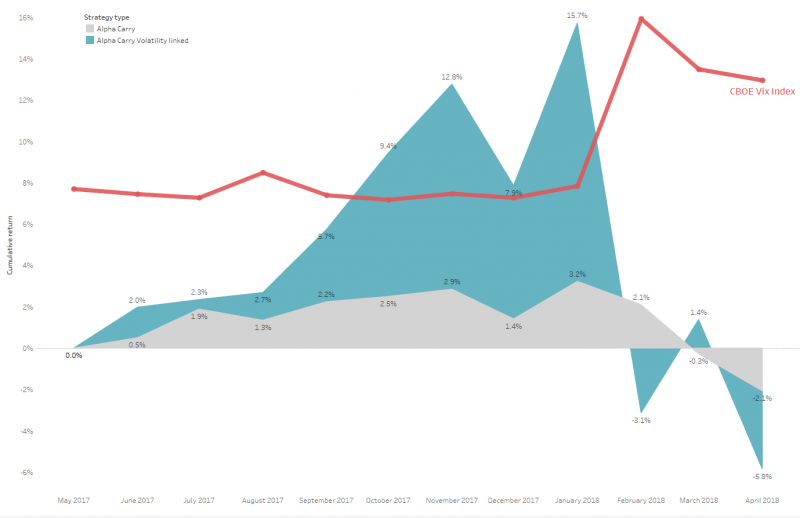

The year 2018 started with the equities market following the positive trend of the fourth quarter of 2017. The market showed positive returns and relatively low volatility until February’s big hiccup were the VIX index ended up 20.01 points at 37.32, its highest close since August 2015. The prices were pulled down and volatility rose to a level not seen in months putting an end to the positive trends.

In the face of turbulence, alpha-seeking carry strategies have turned defensive to minimize potential loses and are just now starting to move to progressive recovery phase.

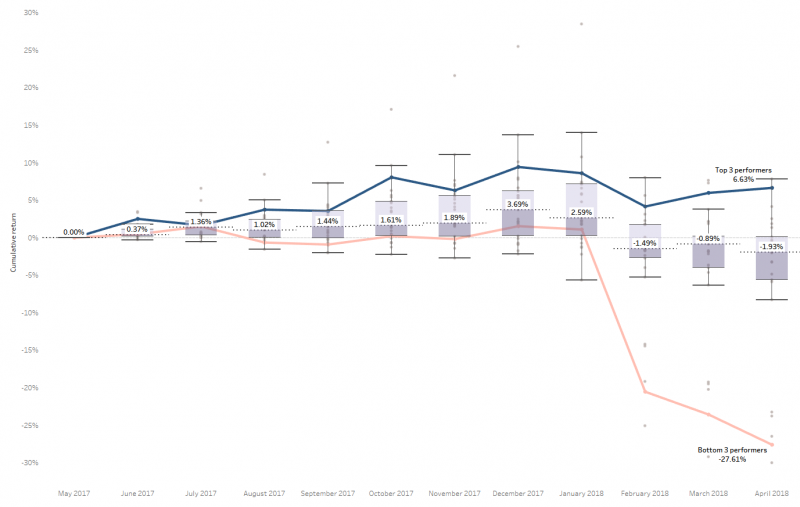

The chart is a monthly comparison of twenty-nine alpha-seeking carry strategies by major investment banks and asset managers and are suited to institutional investors. As can be clearly seen, the average monthly return is still negative from February 2018, the bottom three performers were down to -27.61% and the top three managed to score a difficult 6.63%.

Although some funds suffered loses of their accumulated returns, few still managed to avoid these loses making the median reaction relatively moderate.

Among the twenty-nine strategies, the twelve volatility linked ones showed excellent performance prior the turning point of February that balanced back the excess returns. Indeed, following the VIX index peak, the worst impacted alpha-seeking carry strategies were logically the volatility linked ones. It will be interesting to see how fast they can recover should the market still be calm in the coming weeks and months.