Let’s consider a portfolio of 8 absolute return Risk Premia strategies, from different providers and asset classes, and having at least 3 years of track record.

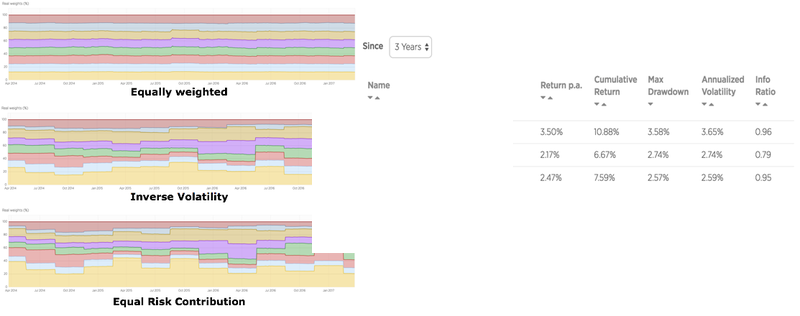

If the strategies are Equally Weighted, transaction costs will be limited and it is easy to understand.

With an Inverse Volatility weighting scheme, the impact of the strategies is smoothed resulting often in a lower overall portfolio volatility and maximum drawdown.

With relevant parameters, Equal Risk Contribution can also be an interesting method to limit the risk while not affecting the portfolio upside potential.

The choice of the weighting method typically depends on:

- your appetite for complexity (some weighting algorithms can quickly become a black-box which you have no control over)

- the transaction costs of the strategies

- the stability of the strategy returns. In particular, carry trades tend to have a correlation and volatility difficult to assess

- constraints like minimum and maximum weights for each strategies