When it comes to build a balanced cross asset portfolio of Risk Premia, one of the issues that needs to be addressed is the relative weight of each asset class within the basket.

For usual assets this questions is simpler as TAA or macro analysts can help build the shape of a portfolio depending on long term trends. Moreover, the appetite to risk is commonly used to define the ratio of equity versus fixed income, assuming that stocks tend to be riskier on the short term but also more rewarding on the long term.

For absolute return strategies, things are more complex. Of course investors can still take a view and decide that equities need to be overweighted, or that FX has to be lower weighted than fixed income – but it is difficult to assess the sustainability nor long term potential of risk premia by asset class.

As such, it could be tempting to answer this question by opting for a weighting scheme which takes correlation between strategies into account, such as Equal Risk Contribution, reflecting therefore the correlation between their asset classes.

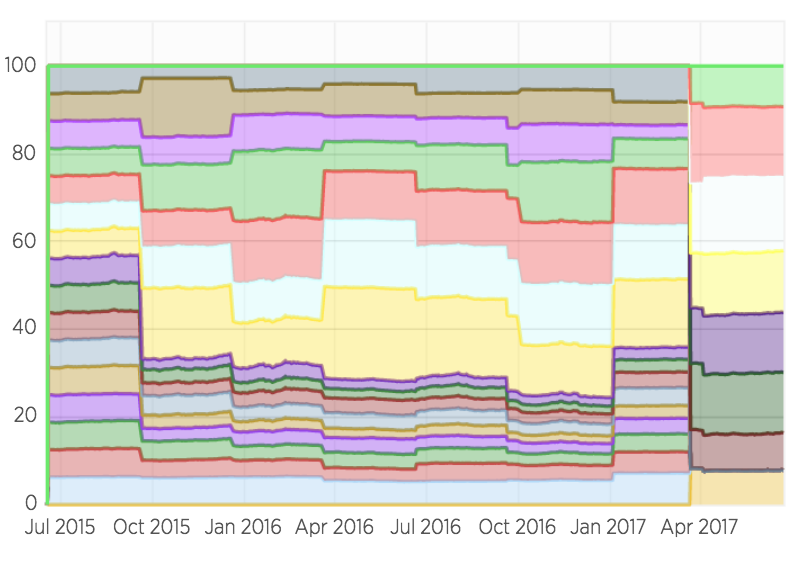

In this case, the parameters of the realised estimators need to be chosen carefully, especially the observation window for realised correlation and realised volatility estimators. It can be useful to check if the return provided by the portfolio depends strongly on this observation window, which would represent a certain fragility. On the other hand, if the observation window has little impact on the portfolio statistics over a long enough period, it tends to show its relative resilience and robustness.