Equal risk contribution (ERC) and inverse-volatility portfolios that are frequently rebalanced should be rebalanced using large window sizes of recent data in order to generate the best information ratios.

The information ratio measures excess returns per unit of volatility risk, essentially gauging how consistent a strategy’s outperformance over a benchmark is. The higher the information ratio, the better.

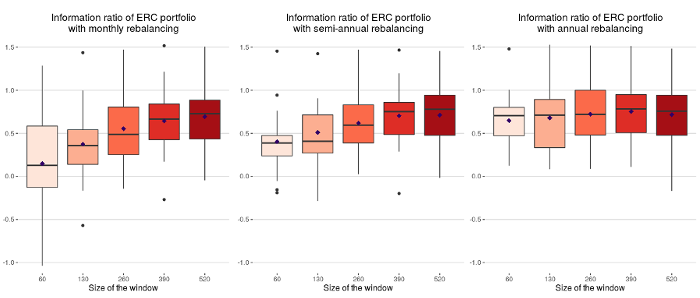

A report by Quantilia found that large window sizes, in this case 390 and 520 days, seem to deliver the best mean rolling information ratios for portfolios that are rebalanced monthly, quarterly or semi-annually.

Window size refers to the number of days’ worth of data used when calculating adjusted portfolio weights.

In the case of annual rebalancing, the window size used for rebalancing does not have a material effect on information ratios, and so no recommendation is given in the report. On the other hand, more frequent portfolio rebalancing requires larger window sizes of data in order to maintain high information ratios.

The Quantilia report was based on 20 baskets of 20 strategies each, with a split between alpha and beta strategies and exposure to different asset classes and strategy providers. The different window sizes used were 60, 130, 260, 390 and 520 business days, while the weighting schemes used were ERC and inverse-volatility.

ERC funds are weighted in such a way that each security contributes equally to total portfolio risk, thereby reducing the risk concentration of the portfolio. This is similar to the inverse-volatility approach, though the ERC strategy also accounts for the correlations between securities within the portfolio.

Smart beta strategies in particular require relatively frequent portfolio rebalancing in order to keep them within their predefined strategy boundaries. Some strategies, or underlying risk factors, require more frequent rebalancing than others.