The transaction costs associated with portfolio rebalancing tend to weigh on the information ratios of equal-risk-contribution (ERC) portfolios more than inverse-volatility and equal-weight strategies.

The information ratio measures excess returns per unit of volatility risk, essentially gauging how consistent a strategy’s outperformance over a benchmark is. The higher the information ratio, the better.

A report by Quantilia found that transaction costs significantly affect the information ratios of ERC funds, while inverse-volatility schemes are less affected and equal-weight portfolios were only slightly impacted.

ERC funds are weighted in such a way that each security contributes equally to total portfolio risk, thereby controlling overall volatility risk. This is similar to the inverse-volatility approach, though the ERC strategy also accounts for the correlations between securities within the portfolio.

Inverse-volatility schemes only take volatility into account in the balancing and rebalancing process.

The Quantilia study was based on 20 baskets of 20 strategies each, with a split between alpha and beta strategies and exposure to different asset classes and strategy providers. The report used different rebalancing frequencies – ranging from monthly to annually.

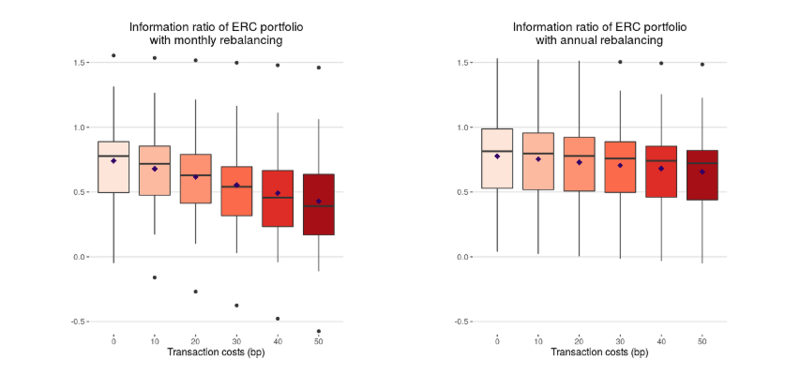

The effect of transaction costs – which ranged from zero to 50 basis points – were most pronounced under ERC schemes. The mean of the rolling information ratios fell from 0.74 to 0.43 when the portfolio was rebalanced monthly and from 0.78 to 0.66 when the portfolio was rebalanced annually.

Mean information ratios declined by 42% in ERC portfolios (across the spectrum of transaction costs and rebalancing frequencies), compared with a 20% fall in inverse-volatility funds. As expected, the equal-weight portfolio was only slightly affected.

Smart beta strategies in particular require relatively frequent portfolio rebalancing in order to keep them within their predefined strategy boundaries.