Most large asset managers add alpha strategies (sometime risk premia funds) to their portfolios as additional return drivers. Often uncorrelated to the other constituents in a usual equity fund, an alpha element also acts as a source of diversification and a manager of risk.

Before inserting an alpha strategy into a portfolio, which can then be separated into a beta component and alpha part, investors need to decide on appropriate benchmarks since the performance of long-only alpha funds is measured on a risk-adjusted basis against a benchmark.

Alpha measures how much an investment – usually an actively-managed strategy or alternatively-weighted index – beats the chosen benchmark.

Usually in the form of an index like the S&P 500 (which weights constituents based on their size), a benchmark provides a standard against which funds or financial products can be compared. Funds in the UK can benchmark themselves against the FTSE UK Index Series range, for example. A European equivalent might be the S&P Europe 350 index. Around the world, the most highly regarded benchmark indices of equity markets include the S&P 500, Nasdaq Composite and Russell 2000. Investors can decide on the most appropriate benchmark based on the markets in which they operate.

For example, if an investor’s fund includes mainly large US stocks, the S&P 500 Index would likely be the benchmark of choice. If this benchmark returns 4% over a given period while the fund records a 6% gain, then that fund’s alpha value is 2% since it beat the benchmark index by 2 percentage points. Conversely, a negative alpha value represents underperformance.

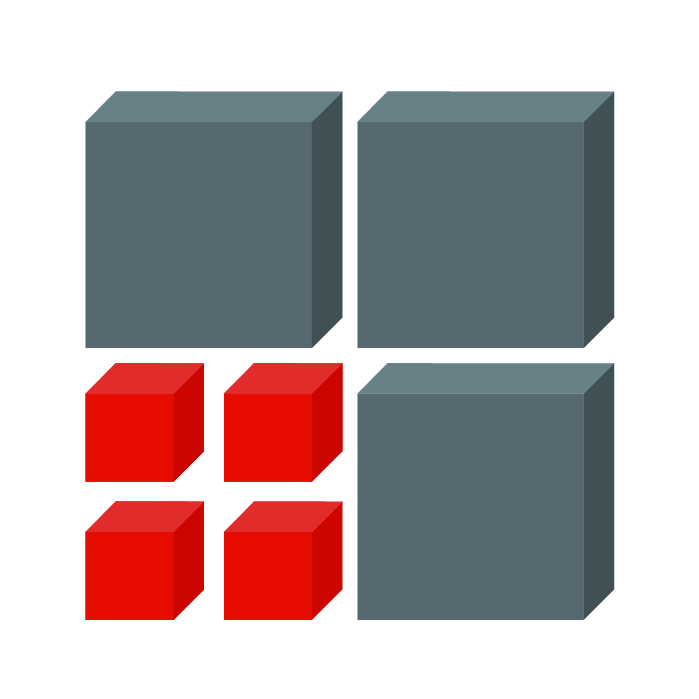

The alpha component of a portfolio seeks to boost returns of the overall portfolio, while the beta investment component targets market-related returns.

Most large investment management firms now have dedicated alpha strategy teams. Many of these aim to outperform benchmarks by around 3% on a net basis, for example, while alpha strategies also usually have risk-control mechanisms built into them in addition to controlling total risk through diversification.

Alpha strategies include equity funds where stock selection, focused around identifying market winners, is based on research and analysis. Hedge fund strategies are also a common inclusion in alpha portfolios, though they are usually only available to large, professional funds.

Alpha portfolios can range from an investment which has both a beta and alpha component (such as mutual funds since stocks have both market exposure and idiosyncratic risks), to “pure alpha” – which includes hedge funds and risk premia strategies (regarded as pure since these strategies isolate idiosyncratic risks in order to generate returns based on market inefficiencies).

In the case of hedge funds and risk premia, adding an alpha strategy to an overall portfolio can boost returns using investment strategies which are uncorrelated from the rest of the portfolio.

The growing number of passive indices with an actively-managed slant, such as smart beta investment products, means investors are questioning whether actively-managed equity funds are worth paying for. This is partly because of the fees involved with active fund management, since investors can generate alpha through lower-cost financial products including smart beta.

But most agree that active fund management still has a role to play in building portfolios. Quantitative investment techniques such as smart beta use backward-looking data to assess performance, while good fund managers can add value by further screening the market for forward-looking risks and opportunities.

Using alpha and beta together

A portfolio with alpha and beta components ensures investors can passively generate long-term returns from investing in the market as a whole (beta exposure), while targeting specific, uncorrelated risks which can be used to boost overall returns (alpha exposure). Combining the two helps investors in the control of risk, while also adding a few percentage points’ return to what the market delivers.

To measure the performance of a fund on a risk-adjusted basis, investors have a number of financial tools at their disposal, including risk rations like alpha and beta.