Factor investing too often relies on marketing declarations or on the assumption that a label put next to a time serie would be a guarantee of its behavior. Quantila is now offering equity factor computations on thousands of equity risk premia and smart beta strategies, for more than 25 markets.

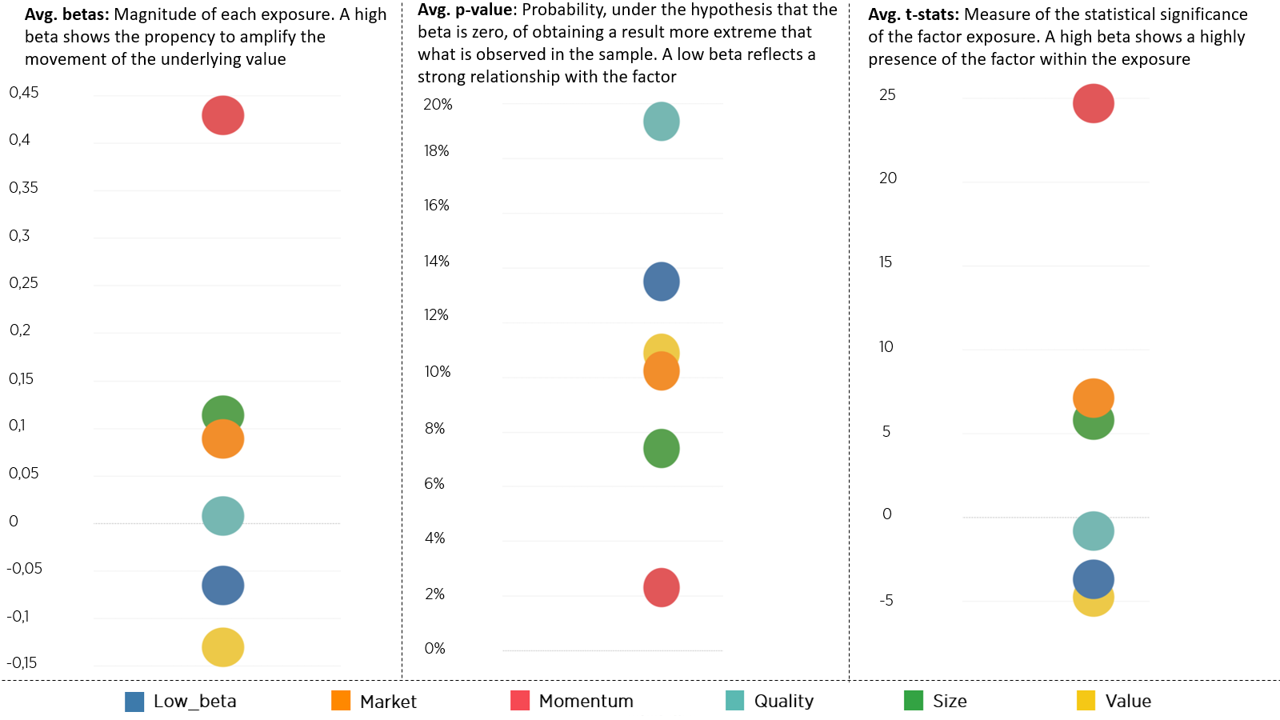

We have for example studied hundreds of “momentum called” strategies and analyzed their factor decomposition. The good news, their is indeed momentum factor in most of them, and quite significantly. The bad news, there are also strategies with a poor or not really reliable momentum factor exposure.

Most momentum risk premia strategies do have momentum exposure

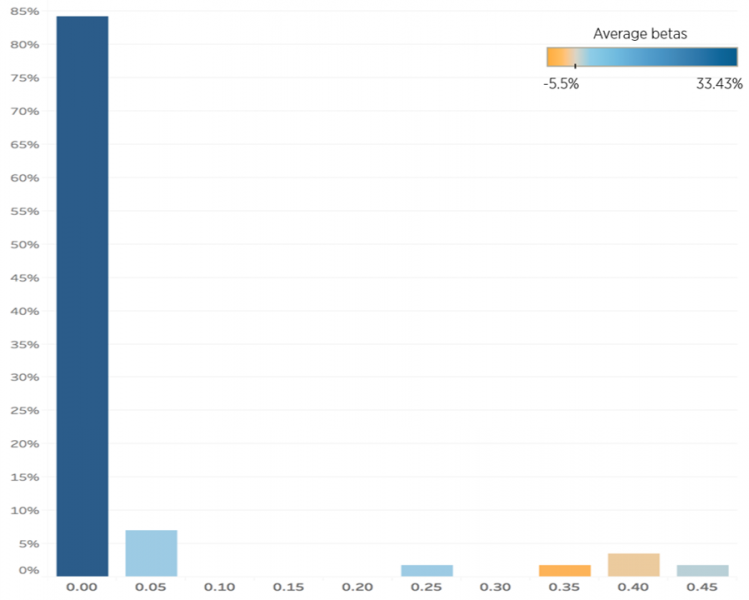

However, there are also some momentum strategies which do not have a significant momentum factor exposure and which still are labelled as “momentum strategies”. On a sample of 50 so called “momentum” risk premia and smart beta indices, we see that, if a large majority has a very significant exposure to this factor, some have a poor or insignificant exposure to momentum.

For the complete study by factor and country, please contact us