Proprietary indices have been widely adopted as alternatives to usual structured investment products, particularly since the global financial crisis of 2008. Sometimes referred to as ‘self-indexing’, these indices allow investment banks and asset managers to reduce fees and customise their offerings.

One type of proprietary index is called ‘smart beta’ – an investment strategy which has become a major driver of the index and particularly exchange-traded fund (ETF) market globally. Smart beta funds aim to improve on benchmark indices (which generate returns associated with the market risk premium).

Similarly, risk premia products can also fall under the proprietary-index umbrella.

Smart beta funds build proprietary indices based on a set of rules, with the aim of generating the market-beating returns sought by active fund management together with the more cost-effective index-tracking approach of passive investing.

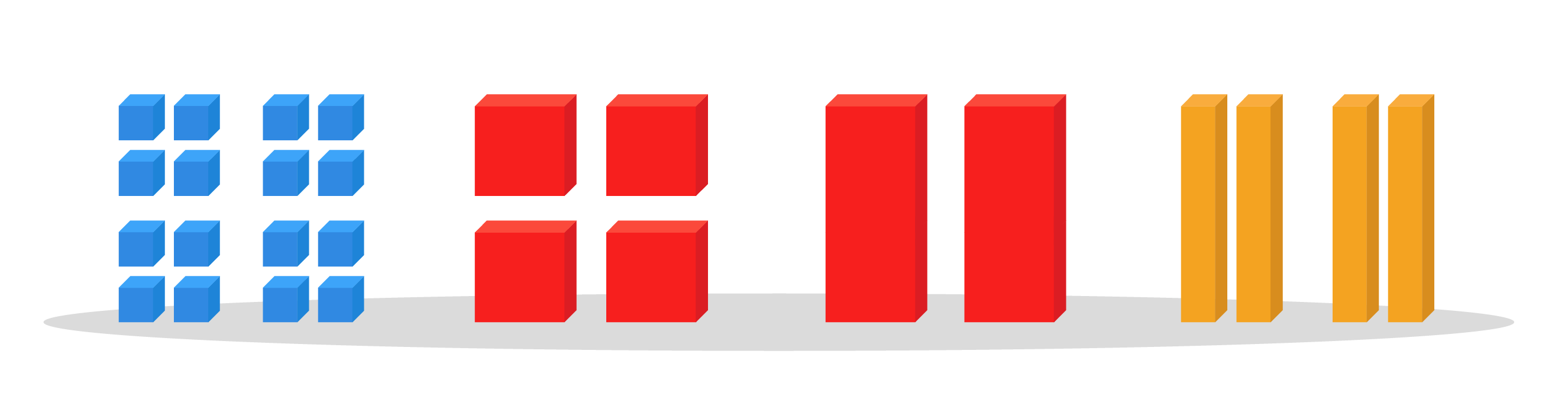

Smart beta refers to alternative index construction: rather than tracking a benchmark which weights stocks by their size, smart beta strategies weight constituents based on other factors. Similarly, risk premia strategies can involve buying (going long) an alternatively-weighted smart beta index and selling (going short) the benchmark index – with the aim of generating absolute returns and outperforming the market.

Investment banks and asset managers build their own proprietary indices based on a set of rules-based methodologies. Constructing a proprietary index in-house can eliminate the need for banks to pay fees to usual index providers, and allow them to construct their own indices based on their unique needs and rules. Constructing a proprietary index is methodical, using predefined factors that control stock selection and weighting.

Potential investors wanting to track a proprietary index need to pay the bank or asset manager a fee to do so, since these index providers are owners of the index and its intellectual property rights. Proprietary indices are often only available to a limited number of clients, or can even be tailored for individual clients, with the main target market being institutional investors.

But despite the in-house nature and relative exclusivity of proprietary indices, a number of parties are usually involved in the building and maintenance of each index.

Most often, the index provider passes its methodology on to a third-party index-calculation agent. This agent calculates the index’s net asset value (NAV) daily. While this can be done in-house, the trend is towards using independent third-party index calculators. For example, a calculation agent such as S&P can calculate proprietary indices for large investment banks.

Further, index providers can use external brokers to concretely buy and sell the different assets within each index in order to make indices investable, though this is often done in-house.

Regulation uncertainty

While comprehensive information relating to the methodologies behind benchmark indices like the S&P 500 Index is published for public access, proprietary indices are not always as transparent. As such, proprietary indices have come under scrutiny in many jurisdictions including the US and Europe. Some banks have even been fined for misleading clients about their methodologies.

Regulators have been working on improving regulations for the proprietary index market, since this relatively new and niche segment of the investment industry falls in a grey area between active fund management and traditional passive indices. Regulators with a close eye on proprietary index markets include the European Securities and Markets Authority and the US Securities and Exchange Commission.

Regulatory changes focus on governance and information requirements. Some critics believe investors can be abused if a provider and index administrator has a direct financial interest in the index. In the case of discretionary indices, providers or calculation agents might be deemed as having a conflict of interest when making a decision.

But some index providers have argued that full public disclosure essentially renders proprietary indices as public goods and undermines the time and resources spent on building and maintaining them. They also maintain that investors are able to analyse information including index data and methodologies since they are subscribers.

But any regulation uncertainty that may linger has not held back the growth of the proprietary index market. ETF-manager BlackRock expects the value of smart beta ETFs to skyrocket to $1 trillion globally by 2020, from $282bn in the first half of 2016.

Smart beta indices are built using factor investment techniques, whereby stocks are selected based on risks and features which are expected to yield higher returns than the market.

Investors can measure the excess return of a proprietary index, or returns above or below those generated from the benchmark, by analysing the index’s alpha value. Including an alpha overlay strategy in a portfolio, meanwhile, can help control a fund’s volatility and improve risk-adjusted returns.

Since portfolio construction, as well as selecting appropriate indices or strategies, hinges on finding the most appropriate balance between risk and return, investors need to be able to measure and analyse the risk premium of both macro equity markets and investments in order to make sound selections.