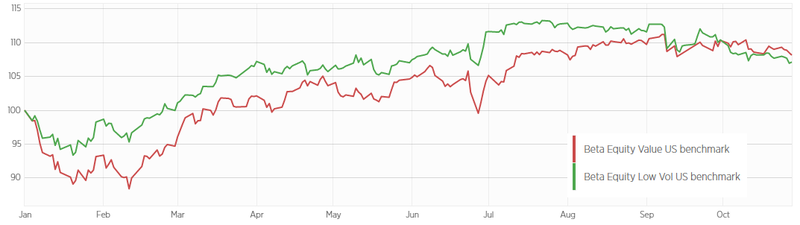

Quantilia’s low volatility US reference basket has recorded the steadiest performance of the data provider’s factor-based benchmarks so far this year, while also outperforming the market.

The Beta Equity Low Vol US benchmark reflected a maximum drawdown of 6.6% year-to-date, the lowest peak-to-trough decline among Quantilia’s seven non-investable factor-based reference baskets.

As would be expected, the largest drawdowns experienced by the benchmarks this year occurred during the global equity market selloff in January and early February.

At just under 12%, the low volatility benchmark index also has the lowest annualised volatility in 2016.

Maximum drawdown, a measure of downside risk, is the biggest loss from a high to a low point of a portfolio before a new peak is reached. This indicator of capital preservation helps investors to analyse investments based on their ability to weather bear market conditions.

Low volatility strategies tend to suffer less during periods of market weakness, while also capturing most of the upside associated with bull markets. As a result, they can outperform on a risk-adjusted basis over the long term.

The Beta Equity Low Vol US benchmark, which is comprised of a basket of ETFs and unlisted indices on the Quantilia platform that track consistent and stable US stocks, has returned 8.5% year-to-date while the S&P 500 Index has appreciated by 5.9%.

Quantilia’s Beta Equity US Small & Mid Cap reference basket has delivered the highest return so far this year, of 12.4%. The yield US benchmark has risen by 12.2%, followed by the value US portfolio (9.7%), low volatility US (8.5%), quality US (7%), multifactor US (6.5%) and momentum US (4.9%).

The momentum benchmark recorded the highest max drawdown value, of 12%.

Quantilia’s reference baskets are rebalanced quarterly and performances are net of management fees and transaction costs. They are for reference purposes only, allowing investors to more accurately measure the performance of factor strategies.

Quantilia is the first data and portfolio management platform dedicated to quant, or factor-based, investments, including smart beta and risk premia indices. The site includes OTC-traded strategies and caters mainly to institutional investors.