Amongst the fintech companies that get a lot of attention, we see companies operating in the payments, peer to peer lending, cryptocurrency, personal finance, and crowd funding segments. The changes brought by fintechs in the institutional investment space have been subtler. However, some of the methods developed by successful consumer facing fintech companies are now being introduced to institutional investing. As fintechs introduce more intuitive and engaging tools, we can expect a new investing landscape to evolve around them.

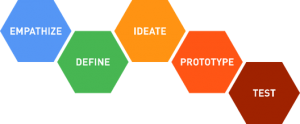

Much of this has to do with the way fintech companies are focussing on design thinking and the user experience. Design thinking is far more than the way graphic designers package a product. Rather, it is the process of creating better solutions by getting a better understanding of the user. Until the last few decades, companies concentrated on the product, then left it to the marketing and sales teams to figure out how to sell that product. That approach applied across most industries.

But then a few companies in the technology sector, starting with Amazon and Apple, turned that around. They got to know their customers first and then created a user experience for those customers. Since the late nineties, that approach has filtered through to almost ever consumer facing industry.

Companies like Uber and Airbnb took that thinking to the next level and stripped out everything that wasn’t directly related to the user experience. In fact, Airbnb’s founders credit design thinking with turning them around when they were a failing start up.

One of the most common job descriptions amongst the Fintech community is the UI/UX designer or engineer. That’s because creating the user experience is at the heart of nearly every fintech company. The result is that we are seeing start-ups revolutionising almost every part of the financial industry that’s focussed on the consumer. These include companies providing payment solutions, peer-to-peer lending and crowd funding platforms, and robo-advisors.

Technology is now making an appearance in the institutional space. And, along with these new technologies, design thinking is being introduced. Banks are experimenting with blockchain technology, and fund managers are incorporating artificial intelligence into their analytical processes. The emergence of robo-advisors has forced asset managers to think hard about their client’s needs. Many of these solutions are being built around a user experience, which will give them a better chance of adoption across the industry. Fintechs observe the critical path of the user. In other words, they are very aware of the point at which a user will give up or lose interest in the product. They can also identify the functionality that improves that efficiency for the user. In doing so, they can ensure user adoption, and improve efficiency by a factor of ten or a hundred.

There is no shortage of tools available to fund or ETFs managers and investors to help them with factor analysis, risk management, portfolio construction and accessing liquidity. But, many of these products may have suffered from a lack of design thinking in the past. A product may be very useful, but if the user experience falls short, potential users might never know how good it really is.

As service providers improve the usability of their tools, asset managers will be able to service their clients more effectively, and institutional investors will have access to a wide array of decision making tools. This will also allow them to broaden their investment horizons too.

Some of the challenges faced by institutional fund managers are nudging the process along. The biggest revolution in the investment industry this century must surely be the rise of passive investing. Active managers, with high overheads, are having to work harder to justify their fees and win new business. During a bull market, it’s difficult for active managers to prove that their process is better than any other process. So, paradoxically, their job has been made more difficult by the equity bull market which will soon enter its tenth year.

Active managers are beginning to use quantitative models to make decisions themselves. The ability to effectively test models based on fundamental data, and even qualitative data is increasingly adding value to their investment process. In fact, analyst forecasts are now being modelled and their effectiveness is becoming a key input for decision making.

In the past institutional investors active with quantitative strategies have been limited by the size of their teams and the resources they have had available to them. New platforms are allowing them to venture into markets where they previously would have lacked resources.

These platforms allow institutional investment teams to make smart decisions about asset allocation and investment styles and factors. They can then combine smart beta or risk premia strategies based on different types of assets, themes, markets and styles. This streamlines the process of building global portfolios with quantitative indices based on robust research.

These types of tools are not entirely new. But the user interfaces are evolving and becoming more user friendly for portfolio managers and analysts. That means they now save time, rather than adding to the user’s workload.

Quantitative analysts and fund managers are busy people, and if they find a product difficult to use they are unlikely to use it. However, as design thinking leads to more user-friendly products, users will have more confidence in them and quickly incorporate them in their day to day process. If a research or reporting platform can create engaging presentations that communicate the data well, then an asset manager will gladly use it to communicate with their institutional clients.

Increased transparency is another benefit that comes with more platform usage. In the past, the methodology used in constructing indices and other data products was often rather opaque. By using data from multiple data sources, fintechs can ensure independence and objectivity in the solutions they offer.

Fintech companies don’t only improve the productivity of asset managers. Pension funds and other asset owners now have access to many of the same tools. These allow them to benchmark fund performance across a wide array of asset classes and markets, and better evaluate the alternatives available to them.

Fintechs operating in the institutional environment may be less visible than their consumer facing counterparts, but they are nevertheless beginning to make a substantial impact in their own way. Because they are incorporating design thinking into the solutions they offer, the investment professionals that use them can immediately see how they can improve productivity. The timing is significant too. As asset managers actively seek out an edge in a tough environment, we are sure to see these fintechs become a key component of the investing ecosystem in the coming decade.