USE CASES

CLUSTERING ANALYSIS

Optimise your portfolio with data science

Achieve real diversification

The diversification of portfolios is more than ever a necessity for investors in order to be protected from high market fluctuations. The implementation of an automated method to classify strategies in statistical homogeneous groups or study the behaviours of different strategies among an eligible universe is thus essential to the investment decision making process and portfolio management practice.

Beyond classical correlation

In the ever-evolving realm of investment strategies, relying solely on traditional correlation metrics has proven to be inadequate for a meticulous assessment of strategies' behavior. Typically measured correlations, calculated during periods of market stability, often fail to accurately capture the true dynamics of portfolio performance during times of crisis. As market conditions become increasingly unpredictable and volatile, investors are compelled to seek alternative metrics that can offer a more comprehensive understanding of portfolio behavior across fluctuating market conditions.

During periods of market stability, conventional correlation metrics may provide a semblance of insight into the interrelationships between different assets within a portfolio. However, when confronted with unprecedented market upheavals, such as those witnessed during economic downturns or geopolitical crises, the efficacy of traditional correlation metrics diminishes significantly. This discrepancy arises due to the inherent limitations of traditional correlation metrics in capturing the nuanced interactions between assets during times of extreme market stress.

Recognizing the inadequacies of conventional correlation metrics, investors are increasingly turning to alternative metrics that offer a more nuanced and robust assessment of portfolio behavior across varying market conditions. These alternative metrics take into account not only the correlations between assets but also the underlying factors that drive portfolio performance during times of crisis. By incorporating factors such as volatility, liquidity, and tail risk, these alternative metrics provide investors with a more comprehensive understanding of portfolio behavior and risk exposure during turbulent market conditions.

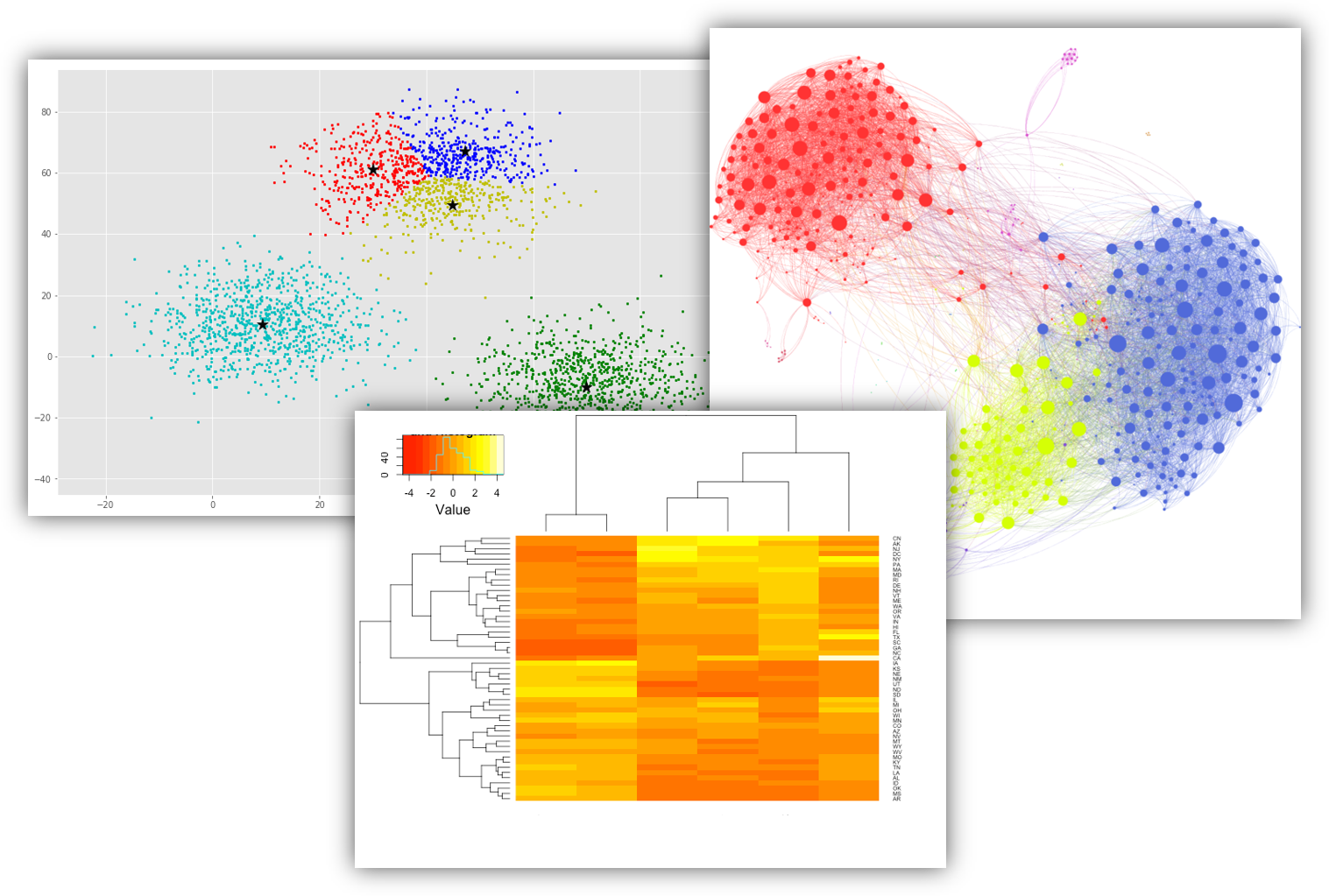

At Quantilia, we understand the limitations of traditional correlation metrics and the need for more sophisticated analytics to navigate today's complex investment landscape. That's why we're dedicated to developing innovative approaches to portfolio analytics that go beyond conventional correlation metrics. By leveraging advanced techniques such as clustering analysis, machine learning, and predictive modeling, we empower investors to gain deeper insights into portfolio behavior and make more informed investment decisions, even in the face of uncertainty and market volatility. With Quantilia, investors can trust that their portfolios are equipped with the tools and analytics needed to thrive in today's dynamic market environment.

Control Your Risks

Risk management for discretionary portfolio managers is a multifaceted endeavor that demands a sophisticated understanding of the intricate dependencies between various models and their potential impact on portfolio risk. Without a comprehensive grasp of these dependencies, risk management can quickly devolve into a risky gamble, leaving investors vulnerable to unforeseen market dynamics and fluctuations. Recognizing the critical importance of mastering the complexity of these dependencies, Quantilia employs advanced techniques such as active learning and artificial intelligence to develop sophisticated algorithms that enable investors to effectively navigate and mitigate portfolio risk.

At the heart of Quantilia's risk management approach lies the integration of active learning and AI-driven algorithms, which empower investors to weigh multiple factors that could impact their portfolios' risk profiles. By leveraging these cutting-edge technologies, Quantilia's in-house developed algorithms are able to identify and assess the potential impact of various risk factors on investors' portfolios, allowing for a more nuanced and informed risk management strategy.

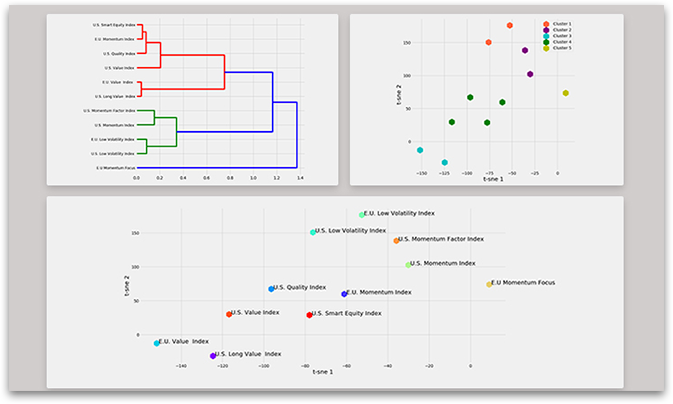

One key aspect of Quantilia's risk management technology is its ability to identify different families of investment products with similar risk profiles. Through sophisticated clustering algorithms and machine learning techniques, Quantilia's platform can categorize investment products based on their risk characteristics, enabling investors to implement diversified strategies that align with their risk tolerance and investment objectives. Moreover, Quantilia's technology allows investors to study the degree of integration and synergy between different investment strategies, providing valuable insights into the potential benefits of portfolio diversification and risk mitigation.

By harnessing the power of active learning and AI, Quantilia empowers investors to take a proactive approach to risk management, enabling them to identify and mitigate potential risks before they materialize. With Quantilia's sophisticated risk management technology at their disposal, investors can navigate today's complex and dynamic market environment with confidence, knowing that their portfolios are equipped with the tools and insights needed to thrive in any market conditions.

Clustering Analysis on Funds

Portfolio Construction And ESG Angle

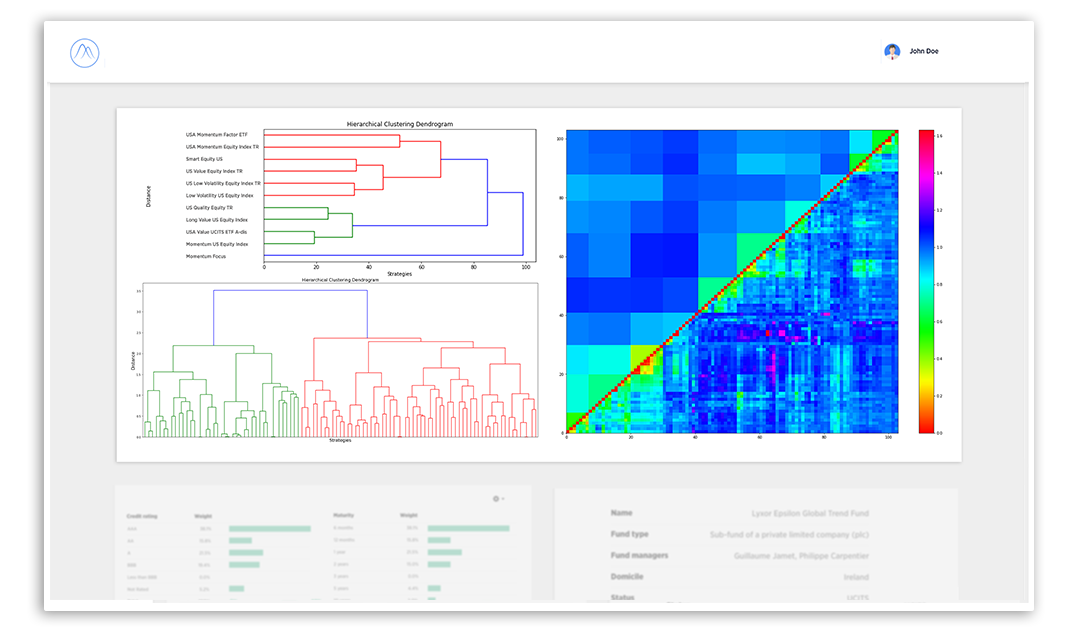

In the dynamic landscape of institutional investment, the ability to effectively manage and analyze diverse portfolios is paramount to success. At Quantilia, we recognize the challenges faced by institutional investors in navigating complex investment landscapes and optimizing portfolio performance. That's why we've developed advanced clustering algorithms that provide institutional investors with the scalability and flexibility needed to effectively manage portfolios with diverse attributes and characteristics.

Our clustering algorithms leverage cutting-edge machine learning techniques to identify groups of investment strategies with similar behaviors and characteristics. By analyzing vast amounts of data, including historical performance, risk metrics, and other relevant factors, our algorithms enable investors to detect outliers and identify patterns that may not be immediately apparent through traditional analysis methods. This allows investors to gain deeper insights into the underlying dynamics of their portfolios and make more informed investment decisions.

One of the key advantages of our clustering algorithms is their ability to forecast the future evolution of investment strategies. By analyzing historical data and identifying patterns, our algorithms can provide investors with valuable insights into how different investment strategies may perform in the future. This foresight allows investors to anticipate market trends and proactively adjust their portfolios to capitalize on emerging opportunities or mitigate potential risks.

Moreover, our internally developed clustering techniques are designed to meet the sophisticated requirements of institutional investors. We understand the need for unbiased and robust tools to optimize portfolio performance and meet the expectations of clients. Our clustering algorithms are rigorously tested and validated to ensure accuracy and reliability, providing investors with the confidence they need to make strategic investment decisions.

In addition to providing advanced portfolio analysis capabilities, Quantilia also offers investors the option to incorporate environmental, social, and governance (ESG) considerations into their portfolio construction process. By integrating ESG criteria into our clustering algorithms, investors can align their investment strategies with their sustainability goals and meet the growing demand for socially responsible investing. This integration of ESG considerations further enhances the sophistication and effectiveness of our clustering techniques, providing investors with a comprehensive toolkit for portfolio optimization.

In conclusion, Quantilia's clustering algorithms offer institutional investors a powerful and scalable solution for portfolio analysis and optimization. By leveraging advanced machine learning techniques and incorporating ESG considerations, our algorithms enable investors to gain deeper insights into their portfolios and make more informed investment decisions. With Quantilia's clustering algorithms at their disposal, investors can navigate today's complex investment landscape with confidence and achieve their investment objectives with precision and efficiency.

Portfolio Monitoring Platforms

Quantilia as a research partner

At Quantilia, we pride ourselves on being a fully independent partner dedicated to empowering investors to achieve their investment objectives. Our DNA is rooted in data engineering, with a significant portion of our team comprised of engineers with backgrounds in banking or finance. This unique blend of expertise enables us to develop top-notch algorithms and cutting-edge solutions that cater to the evolving needs of institutional investors.

As a trusted partner, we are committed to guiding our users through every step of their portfolio's life cycle. From initial strategy development to ongoing monitoring and review, we provide investors with the tools and insights they need to stay on track and aligned with their goals and vision. Our unconventional academic methods and rigorous accountability measures ensure that investors can navigate the complexities of the investment landscape with confidence and precision. We have also forged successful public and private partnerships, which have enabled us to collaborate closely with leading academics in the field. These collaborations have enriched our research and development efforts, allowing us to leverage cutting-edge academic insights to enhance our solutions and provide greater value to our clients.

At Quantilia, we understand that success in investing requires more than just access to data—it requires the ability to harness that data effectively and translate it into actionable insights. That's why we invest heavily in research and development to continuously innovate and improve our offerings. By staying at the forefront of technological advancements and industry best practices, we empower investors to run their best race and achieve their investment goals with clarity and conviction.