TAILORED DATA & PORTFOLIO ANALYTICS

Quantitative solutions dedicated to financial and ESG performance

GET STARTEDTAILORED DATA & PORTFOLIO ANALYTICS

Quantitative solutions dedicated to financial and ESG performance

GET STARTED

Screen market opportunities

Direct source of prime & clean data

Dive into an immersive clean financial platform combining sophistication and user friendliness. Build multi-criteria ranking, enhanced search, bespoke indicators and metrics.

A top-notch platform consolidated with tens of thousands of funds, ETFs, indices, securities and investment solutions from the top investment banks and asset managers.

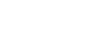

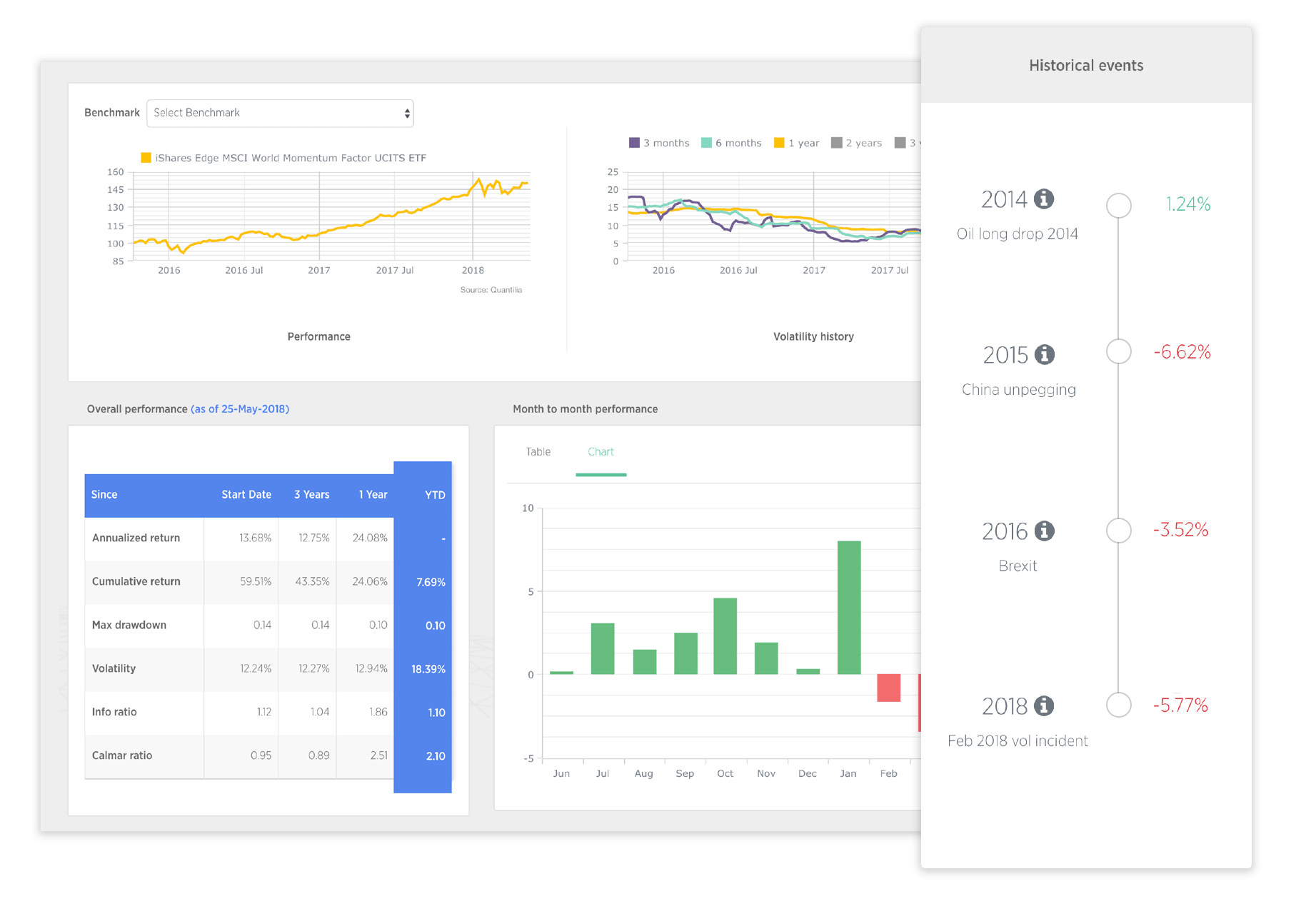

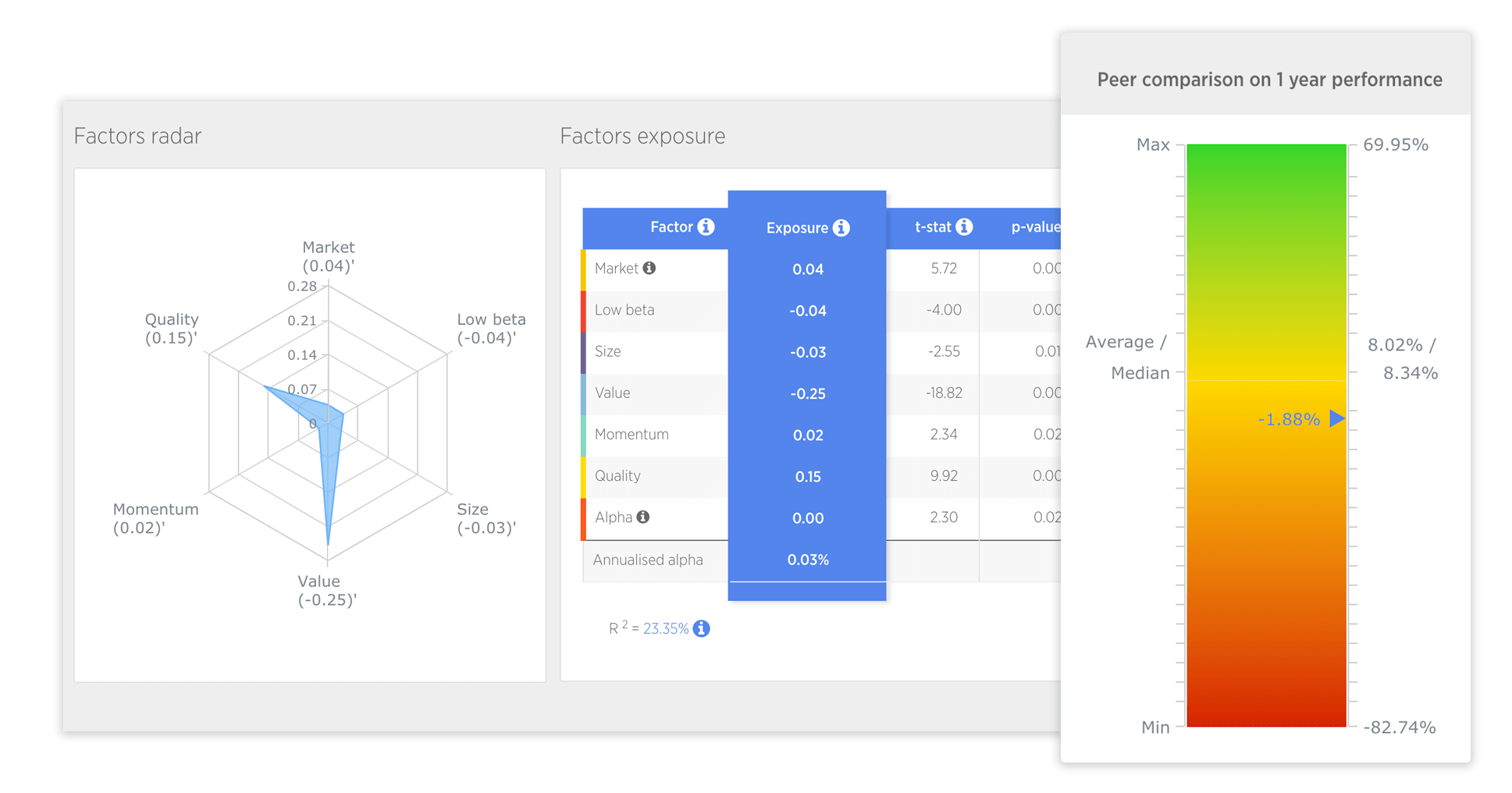

Rediscover your portfolio

Enhanced performance and risk analytics

Extensive analytics for actionable and prescriptive insight: performance contribution and attribution, factor analysis, risks reports, clustering.

Slash the time needed to analyse, exploit and categorize data. Benefit from enhanced visualisation tools with custom made display suited to each team and organisation, from ESG analysts to portfolio managers.

Actionable AI and ESG analytics

Achieve better financial and non-financial performance

Leverage on the latest portfolio management techniques to enhance your financial and non-financial performances, to make your ESG policy a winning financial strategy.

Bring artificial intelligence to life with active learning clustering techniques

250K

assets mapped

135B+ assets under reporting (USD)

400+ connections with banks, AMs and sources

35+ active clients